Credit Card Debt Consolidation loans in the UK simplify management of multiple credit card debts by combining them into a single loan with potentially lower interest rates. Borrowers should strategically compare lenders, maintain strong credit history, negotiate terms, and regularly review their financial situation to secure competitive rates and pay off debt faster.

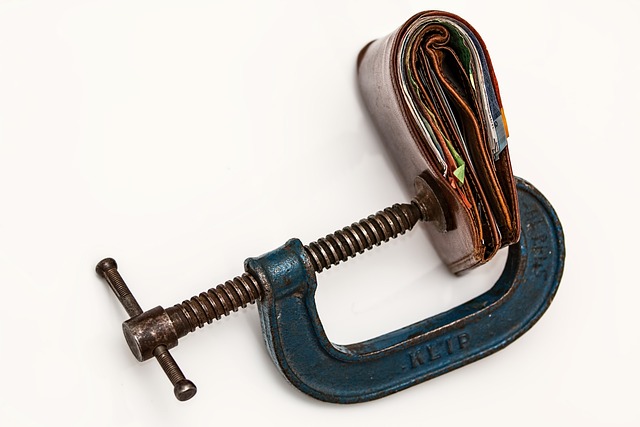

In the UK, managing credit card debt can feel overwhelming. Good news exists in the form of Credit Card Debt Consolidation Loans, offering a strategic path to financial freedom. This article delves into how these loans work and highlights the importance of securing competitive interest rates for your investment. Understanding this process empowers borrowers to make informed decisions, ultimately saving money and alleviating debt stress. Whether exploring options or seeking guidance, this guide provides valuable insights into UK consolidation lending.

- Understanding Credit Card Debt Consolidation Loans in the UK

- How to Secure Competitive Interest Rates for Your Loan

Understanding Credit Card Debt Consolidation Loans in the UK

Credit Card Debt Consolidation loans in the UK are designed to help individuals manage multiple credit card debts by combining them into a single, more manageable loan. This strategy simplifies repayment by reducing the number of payments needed each month and potentially lowering the overall interest rate. By consolidating credit card debt, borrowers can save money on interest charges and make their financial lives easier to navigate.

In the UK, these loans are offered by various lenders, including banks and building societies. They often come with competitive interest rates, making them an attractive option for those burdened by high-interest credit card debt. Borrowers should carefully consider their financial situation and compare different consolidation loan offers to ensure they find the best terms that align with their needs.

How to Secure Competitive Interest Rates for Your Loan

Securing competitive interest rates for your credit card debt consolidation loan in the UK involves a few strategic steps. First, compare multiple lenders and providers to understand the market rates. Look beyond just the advertised figures; consider hidden fees and charges that could inflate the overall cost. Second, enhance your application’s appeal by maintaining a good credit history. Timely payments and a low debt-to-income ratio can significantly improve your odds of securing a lower interest rate.

Additionally, be open to negotiating terms with lenders. Some may offer better rates in exchange for setting up direct debits or agreeing to specific repayment conditions. Regularly review your financial situation and, if possible, aim to pay down debt faster to take advantage of lower interest rates over the long term.

When considering a bad credit debt consolidation loan in the UK, understanding the process and securing competitive interest rates can be key to managing your financial burdens effectively. By exploring various loan options and comparing rates, you can find a solution that aligns with your needs and helps you gain control over your finances. Remember, a well-informed decision can lead to significant savings and a brighter financial future.