Credit card debt consolidation combines multiple high-interest debts into one lower-rate loan, saving money on interest, simplifying payments, and empowering individuals to regain control of their finances. Choosing the right consolidation loan (secured or unsecured) tailored to your credit is crucial. After consolidating, create a strategic repayment plan, review terms, prioritize high-interest debts, and maintain a budget for long-term financial stability. Avoid pitfalls like hasty decisions or relying solely on consolidation; seek expert advice from reputable organizations. In the UK, low-interest consolidation options aid individuals with bad credit in rebuilding financial health over time.

Struggling with multiple credit card bills? Credit card debt consolidation could be your path to financial freedom. This comprehensive guide breaks down everything you need to know about consolidating debt, from understanding the basics to choosing the right loan option and efficient repayment strategies. Learn how this process can save you money and provide long-term financial stability. Discover tips to avoid common mistakes and reclaim control over your finances with credit card debt consolidation.

- Understanding Credit Card Debt Consolidation

- Benefits of Consolidating Debt for Savings

- Choosing the Right Consolidation Loan Option

- Strategies to Repay Consolidated Loans Efficiently

- Common Mistakes to Avoid During Debt Consolidation

- Tips for Long-Term Financial Stability After Consolidation

Understanding Credit Card Debt Consolidation

Credit card debt consolidation is a strategic financial move where multiple high-interest credit card debts are combined into one loan with a lower interest rate. This approach allows individuals to simplify their repayment process and save money on interest charges over time. By consolidating, borrowers can say goodbye to the hassle of managing multiple cards and instead focus on repaying a single debt with more manageable terms.

When considering debt consolidation quotes from reputable financial institutions or exploring the best debt consolidation services available, it’s crucial to evaluate your creditworthiness, especially if you have bad credit. Despite challenges with credit history, consolidating credit card debt is still achievable. Lenders offer specialized options tailored for such situations, ensuring individuals can take control of their finances and work towards a debt-free future.

Benefits of Consolidating Debt for Savings

Debt consolidation offers a range of benefits for individuals burdened by multiple debts, especially high-interest credit card debt. By combining several loans or credit cards into one single loan with a lower interest rate, borrowers can significantly reduce their overall monthly payments and save money in the long run. This simple yet effective strategy allows for better financial management as it simplifies repayment processes, making it easier to stick to a budget.

The first step towards debt consolidation is understanding your current financial situation. Evaluating your debts, interest rates, and repayment terms will help determine if this approach is suitable for you. Unlike debt management strategies that often require negotiating with creditors, credit card debt consolidation provides a straightforward path to savings. It empowers individuals to take control of their finances, potentially leading to complete freedom from credit card debt over time.

Choosing the Right Consolidation Loan Option

When considering credit card debt consolidation, it’s crucial to choose an option that aligns with your financial goals and circumstances. The right loan can help you break free from the stop credit card debt cycle and regain control. Researching different types of consolidation loans is essential; each has unique features and benefits. For instance, a secured loan uses an asset as collateral, potentially offering lower interest rates but comes with the risk of losing that asset if repayments are missed. Unsecured loans, while avoiding this risk, usually have higher interest rates.

If you have poor credit, exploring consolidation options specifically tailored for bad credit can be a step in the right direction. These loans often provide a chance to rebuild financial health by simplifying repayment terms and potentially lowering monthly payments. It’s worth noting that debt consolidation vs debt management is a key decision point. While consolidation focuses on combining debts into one loan, debt management involves negotiating with creditors for lower interest rates and fees, which can be more suitable for those seeking to keep their credit cards but need help managing debt effectively.

Strategies to Repay Consolidated Loans Efficiently

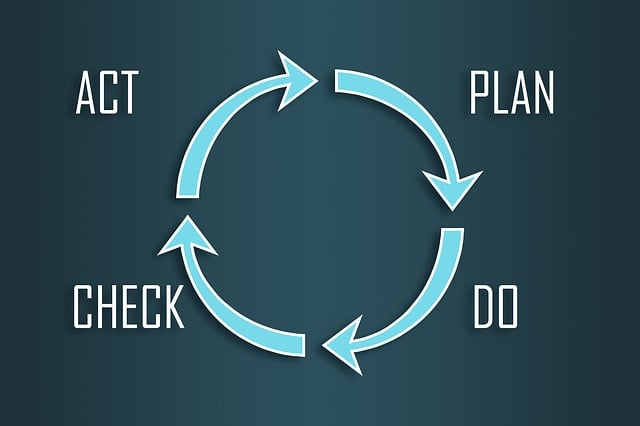

After consolidating your loans, creating a robust repayment plan is key to success. The first step involves understanding your loan terms and prioritizing high-interest debts first. You can use a credit card debt consolidation calculator to determine the most efficient repayment strategy based on your balance and interest rates. Start by paying off the debts with the highest interest rates aggressively while making minimum payments on others. This approach saves you money in the long run.

Regularly reviewing your budget is crucial, as it ensures you stick to your repayment plan. Consider enlisting the help of a debt consolidation service near you for expert guidance and support throughout the process. They can offer valuable insights, tools, and resources tailored to your financial situation, making efficient loan repayment more achievable.

Common Mistakes to Avoid During Debt Consolidation

Many people looking to reduce their bills through debt consolidation fall into common pitfalls that can hamper their progress. One major mistake is rushing into a decision without understanding all the options available. Credit card debt consolidation, for instance, involves combining multiple debts into one with potentially lower interest rates, but it’s crucial to weigh this against other strategies like budgeting and payment plans offered by creditors. Hasty consolidation could mean missing out on more suitable solutions tailored to your financial situation.

Another blunder is relying solely on consolidation as a get-out-of-debt quick fix. While consolidating credit card debt legally can simplify repayment, it doesn’t eliminate the underlying problem of overspending or poor financial management. Without addressing these issues, you’re at risk of accumulating fresh debts or even facing legal troubles down the line. Seeking free debt consolidation advice from experts or reputable organizations can help steer clear of these mistakes and guide you towards lasting solutions for managing your finances, ultimately helping you get rid of credit card debt completely.

Tips for Long-Term Financial Stability After Consolidation

After successfully consolidating your credit card debt, establishing long-term financial stability is a crucial step. One effective strategy is to create and stick to a realistic budget that aligns with your consolidated repayment plan. This involves tracking your expenses, categorizing them, and allocating funds accordingly. By doing so, you gain control over your finances, ensuring essential bills are paid on time and preventing new debt accumulation.

Additionally, consider enrolling in a debt management program to receive expert guidance. These programs offer tailored advice for managing debt effectively, including negotiating with creditors and arranging affordable repayment terms. For those in the UK with bad credit, low-interest credit card consolidation options can be explored, providing relief from high-interest rates and helping to rebuild financial health over time.

Debt consolidation is a powerful tool to take control of your finances and reduce bills significantly. By understanding the process, choosing the right loan option, and implementing efficient repayment strategies, you can save money and achieve financial stability. Avoid common pitfalls and follow tips for long-term success to make credit card debt consolidation a game-changer for managing your debt effectively.