Debt consolidation loans simplify multiple debt management by combining debts into a single loan with lower rates, reducing stress. Utilizing a debt consolidation loan calculator estimates savings and repayment terms based on current obligations. This method is beneficial for seniors seeking financial relief and simplifies monthly payments. Calculators help determine repayment potential, saving money and time by combining high-interest loans into one lower-interest loan with manageable terms, reducing overall interest paid over time.

Stress from overwhelming debts can take a toll on your mental health. Effective debt consolidation through a loan calculator and strategic planning can ease this burden. This article guides you through understanding debt consolidation loans, calculating repayment potential using a debt consolidation loan calculator, exploring benefits of streamlined payments, identifying the best calculator tools, securing a loan, and creating a budget for successful loan management.

- Understanding Debt Consolidation Loans

- Calculating Loan Repayment Potential

- Benefits of Streamlined Debt Payments

- Finding the Right Loan Calculator Tool

- Steps to Secure a Debt Consolidation Loan

- Effective Budgeting for Loan Success

Understanding Debt Consolidation Loans

Debt consolidation loans offer a strategic approach to managing multiple debts by combining them into a single loan with a lower interest rate. This simplified repayment structure can significantly reduce the stress and financial strain associated with juggling various creditors. By using a debt consolidation loan calculator, individuals can estimate their potential savings and repayment terms based on their current debt obligations.

This method is particularly beneficial for seniors or anyone seeking debt relief. Debt consolidation for seniors allows them to streamline their monthly payments, making it easier to manage their finances. Furthermore, incorporating debt consolidation tips and tricks into your financial strategy can enhance the overall effectiveness of this process. A debt relief calculator app can serve as a valuable tool for planning and tracking your progress toward achieving financial peace.

Calculating Loan Repayment Potential

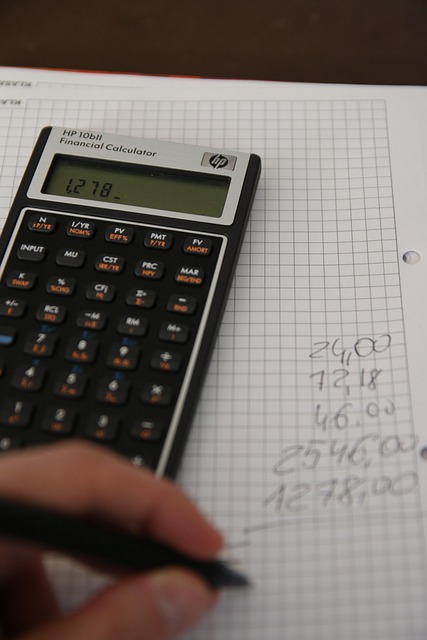

Determining your potential for loan repayment is a crucial step before considering debt consolidation. A debt consolidation loan calculator can help assess your financial situation and available options. By inputting details such as your current debts, interest rates, and monthly income, this tool provides insights into how much you could save and the duration of the new loan. Understanding these factors is essential to making informed decisions about consolidating your debt, ultimately enabling you to stop debt collection calls and get out of debt faster.

Knowing how does debt consolidation work? involves recognizing that it allows you to combine multiple high-interest loans into a single, lower-interest loan with more manageable terms. This strategy simplifies repayment and can significantly reduce the overall interest paid over time. With a debt consolidation loan calculator, individuals gain a clearer view of their financial trajectory, helping them decide if this approach aligns with their goals for managing their debt effectively.

Benefits of Streamlined Debt Payments

Combining multiple debts into a single, manageable payment can significantly ease financial stress. With a debt consolidation loan calculator, individuals can quickly assess their options and choose a repayment plan tailored to their budget. This simplicity offers several advantages, including reduced interest rates and lower monthly payments, ultimately making it easier to stick to a repayment schedule.

A successful debt management solution like debt consolidation can transform challenging financial situations into attainable goals. By consolidating debts, individuals often find themselves with more disposable income, allowing them to prioritize other aspects of their lives. Moreover, secure debt consolidation loans provide peace of mind, ensuring borrowers have a structured and safe way to regain control over their finances and move towards a brighter financial future, as evidenced by many successful debt consolidation stories.

Finding the Right Loan Calculator Tool

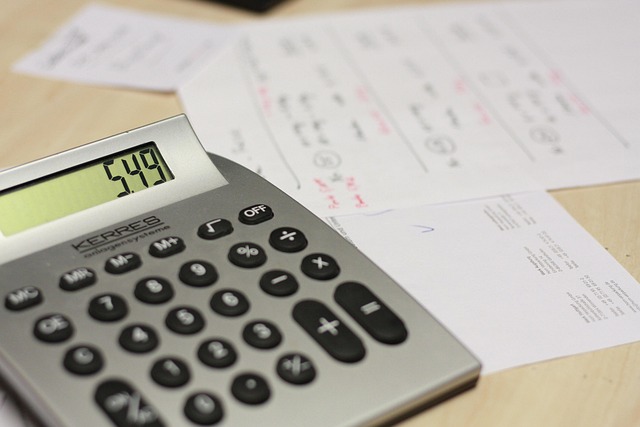

When considering debt consolidation, using a debt consolidation loan calculator is an excellent first step. These tools allow you to input details about your current debts and calculate potential savings by consolidating them into one manageable loan. By comparing different debt consolidation plans using this type of calculator, you can gain insights into how much money you could save over time.

This process empowers you with valuable data-driven insights to make informed decisions. Successful debt consolidation stories often begin with a well-informed borrower who understands their financial situation and chooses the right tool, like a debt consolidation loan calculator, to map out their journey towards financial freedom. Remember, calculating debt consolidation savings accurately can be transformative, helping you break free from debt faster and more efficiently.

Steps to Secure a Debt Consolidation Loan

Securing a debt consolidation loan is a strategic step towards managing and reducing stress caused by multiple debts. The first step is to evaluate your current financial situation. Gather all your financial records, including statements from creditors, and calculate your total debt amount. This will help you understand the scope of your consolidation needs. Using a debt consolidation loan calculator can assist in determining the potential interest rates and repayment terms suitable for your circumstances.

Once you have a clear picture of your debt, it’s time to explore options. Compare different debt consolidation plans available in the market or consider reaching out to non-profit debt help organizations that offer guidance and support. These organizations often provide free consultations and can assist in creating a tailored debt reduction plan. Carefully review each plan’s terms, including interest rates, fees, and repayment periods. A well-planned strategy will ensure you make informed decisions, ultimately leading to effective debt management and reduced financial stress.

Effective Budgeting for Loan Success

Effective budgeting is key to achieving successful debt consolidation. Before applying for a loan, individuals should assess their income and expenses to create a realistic budget. This involves tracking discretionary spending and identifying areas where costs can be reduced or eliminated. A well-structured budget enables borrowers to allocate funds strategically, ensuring they have enough to cover monthly payments while still meeting essential financial obligations.

Using a debt consolidation loan calculator is an excellent way to compare different repayment plans. By inputting loan details, individuals can quickly estimate interest rates and term lengths, helping them choose the most suitable option for their financial situation. Whether considering debt consolidation for seniors or exploring how does debt consolidation work in general, understanding one’s budget is fundamental to making informed decisions and securing a brighter financial future.

Debt consolidation can be a powerful tool to manage and reduce stress related to overwhelming debts. By understanding the basics of debt consolidation loans, calculating your repayment potential with a reliable debt consolidation loan calculator, and implementing effective budgeting practices, you can take control of your finances. Following the steps outlined in this article will help guide you towards securing the right loan for your needs and achieving long-term financial stability. Remember, with diligent planning and a strategic approach, stress reduction through debt consolidation is within reach.