Debt Consolidation Loans streamline home improvement finances by combining multiple high-interest debts into a single loan with a lower rate, simplifying payments and saving money. These loans free up cash flow for renovations but require realistic budgeting and repayment plans due to fixed terms.

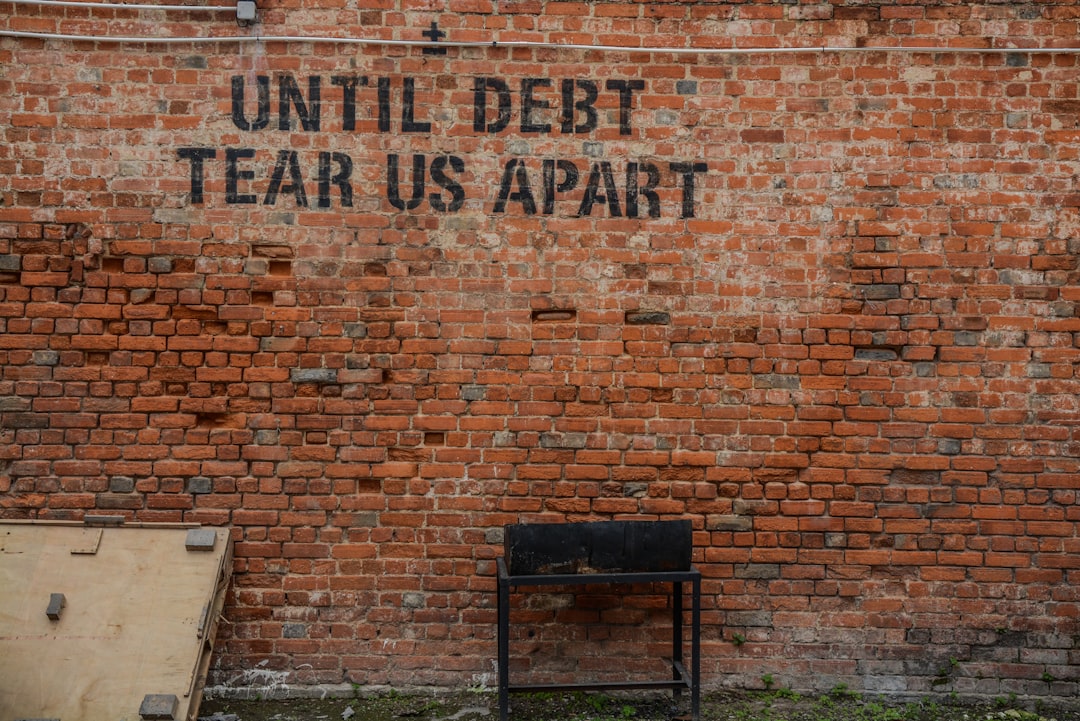

Thinking of transforming your home but overwhelmed by multiple debts? Debt consolidation loans could be your secret weapon. This article explores how homeowners can leverage these powerful financial tools to fund much-needed improvements or renovations. From understanding the basics of debt consolidation mortgages to uncovering their advantages and potential pitfalls, we guide you through the process, helping you make informed decisions for a brighter, updated home environment.

Understanding Debt Consolidation Loans for Homeowners

Debt consolidation loans are a popular option for homeowners looking to fund home improvements or renovations. This type of loan allows borrowers to combine multiple existing debts, such as credit card balances and personal loans, into a single, more manageable payment. By doing so, it simplifies financial obligations and can free up cash flow for larger projects like kitchen remodels, bathroom upgrades, or even new roofing.

These loans work by offering a new loan with a lower interest rate than the total of the consolidated debts. Homeowners then use this centralized loan to pay off their existing creditors, eliminating multiple monthly payments and potentially saving money on interest charges over time. With debt consolidation, homeowners can focus on their home renovation goals without the burden of juggling multiple financial commitments.

Benefits and Considerations of Using These Funds for Renovations

Using a Debt Consolidation Mortgage to fund home improvements can offer several benefits. Firstly, it provides a single, often lower interest rate compared to multiple high-interest loans for various renovation projects. This consolidation streamlines debt management, making repayment more manageable and potentially saving you money in the long run. Secondly, these funds can free up your cash flow, allowing you to allocate resources towards upgrading your living space without the burden of immediate loan repayments.

However, there are considerations to keep in mind. Debt Consolidation Loans typically have fixed terms, meaning any unexpected expenses during renovation projects might strain your finances if not adequately budgeted for. Additionally, while these loans offer a fresh start with better interest rates, they still represent a significant financial commitment. Thus, meticulous planning and realistic expectations about both the cost of improvements and the ability to repay the loan are essential.

Debt consolidation loans can be a powerful tool for homeowners looking to fund home improvements or renovations. By consolidating existing debts into one manageable loan, these funds offer the financial flexibility needed to transform living spaces without the burden of multiple payments. With careful consideration and planning, utilizing debt consolidation mortgages can lead to significant home upgrades while potentially saving money in interest rates. Remember, understanding the terms and benefits is crucial before diving into this financial strategy for your renovation project.