An Unsecured Debt Consolidation Loan is a flexible option for borrowers with good credit to merge multiple high-interest debts into one lower-rate loan, freeing up funds for home improvements. Though with higher interest rates than secured loans, it promotes responsible budgeting and long-term financial health. Evaluating financial health before applying is crucial.

“Thinking of transforming your home but worried about financing? Explore the power of Unsecured Debt Consolidation Loans as a funding solution for your next renovation project. This article delves into how these loans can simplify home improvements by consolidating debts and providing accessible capital. We’ll guide you through the process, highlighting the benefits and considerations of using this strategy to fund your dream makeover without burdening your finances. By understanding What Is An Unsecured Debt Consolidation Loan, you can make informed decisions for a brighter, renovated future.”

Understanding Unsecured Debt Consolidation Loans

An Unsecured Debt Consolidation Loan is a financial tool that allows borrowers to combine multiple debts into a single loan, without using their home as collateral. Unlike secured loans that require an asset as guarantee, unsecured loans offer more flexibility but typically come with higher interest rates. This type of loan can be particularly useful for homeowners planning home improvements or renovations, as it simplifies repayment and potentially saves money in the long run.

When considering an unsecured debt consolidation mortgage for home projects, borrowers should evaluate their financial situation carefully. These loans are ideal for those with good credit scores, as they often attract better interest rates and terms. By consolidating debts into one manageable loan, homeowners can focus on their renovation goals without the added stress of multiple payments, streamlining the entire process.

Benefits and Considerations for Home Improvements

Debt consolidation mortgages, including unsecured debt consolidation loans, offer a strategic way to fund home improvements or renovations. One of the primary benefits is financial simplification. By combining multiple high-interest debts into a single loan with a potentially lower interest rate, homeowners can reduce their monthly payments and free up cash flow. This additional funds can then be redirected towards home improvement projects, such as kitchen remodels, bathroom upgrades, or energy-efficient retrofits.

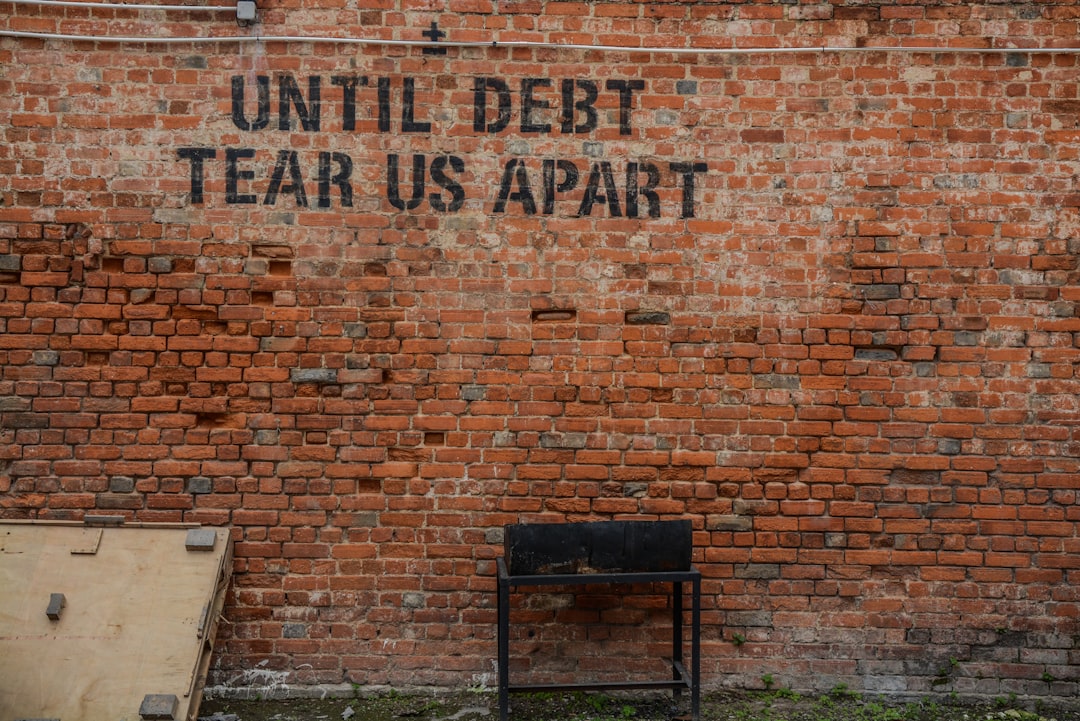

When considering debt consolidation for home improvements, it’s essential to weigh the pros against potential drawbacks. Unsecured loans, for instance, often have higher interest rates compared to secured options tied to a specific asset like your home. Additionally, while consolidating debts can streamline payments, it doesn’t eliminate the underlying need for responsible spending and budgeting to ensure long-term financial health.

A What Is an Unsecured Debt Consolidation Loan? can be a powerful tool to fund home improvements or renovations, offering benefits such as lower interest rates and consolidated debt management. However, it’s crucial to weigh the considerations, like potential risks and long-term financial impact, before taking this step. By understanding these aspects, you can make an informed decision that aligns with your financial goals and enhances your living space.