Debt consolidation loans with fixed rates simplify repayment and improve financial situations by combining high-interest debts. Timely payments are crucial for building a positive credit history. A fixed rate debt consolidation guide ensures your loan positively contributes to your credit score. After consolidation, proactive financial monitoring, reviewing credit reports, and responsible spending habits are key to improving and maintaining a good credit score over time.

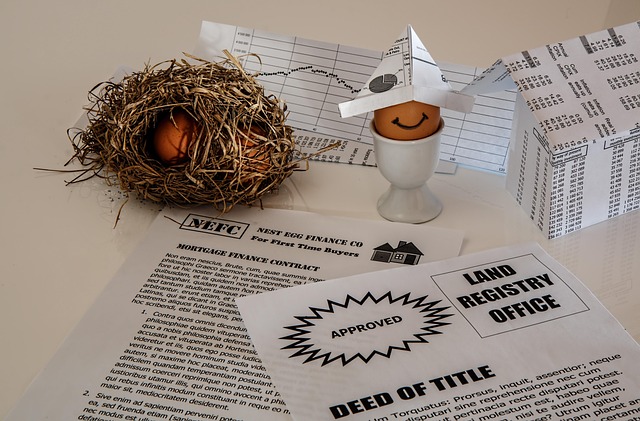

Debt consolidation can be a powerful tool for improving your financial health, but it’s crucial to understand its impact on your credit score. This article explores practical strategies to enhance your credit rating after consolidating debts, focusing on the role of fixed-rate debt consolidation loans. Discover how to rebuild trust with lenders by implementing prudent financial decisions and regularly monitoring your progress. Learn these tactics to transform your credit landscape and secure a brighter financial future.

- Understand the Impact of Debt Consolidation Loans Fixed Rate

- Strategies to Rebuild Credit After Consolidation

- Monitor and Adjust Financial Decisions for Better Score

Understand the Impact of Debt Consolidation Loans Fixed Rate

When considering a debt consolidation loan with a fixed rate, it’s crucial to understand its immediate and long-term effects on your credit score. Initially, consolidating high-interest debts into a single loan at a lower, fixed interest rate can significantly improve your financial situation. This simplifies repayment by combining multiple debts into one manageable payment, reducing the likelihood of missing payments due to complex tracking requirements.

However, it’s important to note that while this strategy offers relief in the short term, maintaining timely payments is essential for building a positive credit history. A fixed rate debt consolidation guide can help you navigate this process effectively, ensuring that your consolidated loan contributes positively to your credit score over time. Prioritizing consistent repayment will demonstrate responsible borrowing behavior to credit agencies, fostering a healthier financial profile.

Strategies to Rebuild Credit After Consolidation

After successfully consolidating your debts, rebuilding your credit score can seem daunting. However, with strategic planning and discipline, it’s achievable. One key step is to choose the right fixed rate loan. This offers stability and predictability, helping you manage your finances effectively. By settling on a fixed rate, you avoid the debt trap of fluctuating interest rates, which can exacerbate your financial burdens.

Focus on making consistent, on-time payments with your new fixed rate loan. This demonstrates responsible credit behavior to lending institutions. Remember, fixing your debt problems with one unified payment stream is not just about consolidating; it’s also about demonstrating your ability to manage credit responsibly. This positive history can significantly improve your credit score over time.

Monitor and Adjust Financial Decisions for Better Score

After consolidating your debts with a fixed-rate loan, it’s crucial to monitor and adjust your financial decisions moving forward. Regularly review your credit report from the three major bureaus to ensure accuracy and identify any discrepancies. This proactive step helps in maintaining a clear understanding of your financial health and promptly addressing any issues that may impact your credit score.

When monitoring, pay special attention to changes in your debt-to-income ratio and payment history. Adjusting your spending habits and ensuring timely payments can significantly influence your credit score over time. Additionally, consider the choice of the right fixed-rate loan that aligns with your financial goals. Consolidating debts under one roof with a low monthly payment structure can make managing your finances more manageable and contribute to fixing your debt efficiently.

Debt consolidation loans with a fixed rate can be an effective tool for improving your credit score. By understanding the impact of these loans, implementing strategies to rebuild credit afterward, and monitoring your financial decisions, you can achieve long-term credit health. Remember, consistent financial management and discipline are key to maintaining a strong credit score.