Debt consolidation loans streamline multiple debt payments into one low-interest loan, saving money and simplifying budgeting. Compare offers based on interest rates, terms, fees, lender reputation, and customer service. Use online tools and seek expert advice for informed decisions tailored to individual financial situations.

Looking to streamline your debts? Explore low-interest rate debt consolidation loans, a strategic financial move for merging multiple high-interest debts into a single, more manageable payment. This article guides you through the process, from understanding debt consolidation loans to securing the best deal. Learn about the advantages of low-interest rates and master the art of comparing loan offers. By following our expert tips, you’ll be well on your way to financial freedom.

- Understanding Debt Consolidation Loans

- Benefits of Low-Interest Rate Loans

- How to Compare Loan Offers

- Securing the Best Debt Consolidation Deal

Understanding Debt Consolidation Loans

Debt consolidation loans are a popular solution for those seeking to manage and reduce their multiple debts. By taking out a single loan with a lower interest rate, borrowers can pay off several existing loans, simplifying their repayment process. This strategy is particularly beneficial when dealing with high-interest credit card debt or multiple personal loans. A debt consolidation loan comparison becomes crucial in this scenario, as it allows borrowers to identify the best offers based on factors like interest rates, loan terms, and repayment conditions.

For individuals struggling with overwhelming debt, consolidating is a strategic step towards financial freedom. It provides clarity by combining multiple debts into one, making it easier to stay organized and make consistent payments. The process involves thorough research and considering various lenders’ offerings. Seeking debt consolidation advice from experts can be invaluable, ensuring borrowers make informed decisions tailored to their unique financial situations.

Benefits of Low-Interest Rate Loans

Low-interest rate debt consolidation loans offer a range of benefits that can significantly improve an individual’s financial situation. One of the key advantages is cost savings; lower interest means less money spent over the life of the loan, making it an attractive option for those looking to pay off debts efficiently. This is particularly beneficial when compared to other types of credit, where higher rates can add up quickly.

Additionally, these loans often provide a simplified repayment process. With a single, consolidated loan, borrowers can say goodbye to multiple monthly payments scattered across various creditors. This simplification not only eases the administrative burden but also makes budgeting and tracking expenses much easier. For those seeking debt relief, finding debt consolidation solutions near them or exploring non-profit debt consolidation services could be a game-changer, allowing them to take control of their finances and move towards financial freedom. A debt consolidation loan comparison can help individuals identify the best option tailored to their needs.

How to Compare Loan Offers

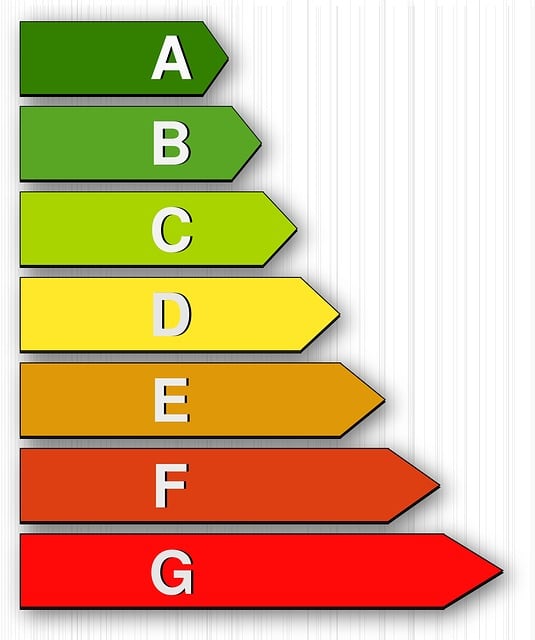

When comparing debt consolidation loan offers, it’s crucial to look beyond the advertised interest rates. Start by understanding the loan terms, including the repayment period and any fees associated with early repayment or late payment. Next, assess the lender’s reputation and customer service track record; reliable lenders offer transparent communication and easy accessibility for answers to your questions.

Consider using best debt consolidation apps reviewed as a resource to gather information on various lenders. These platforms provide detailed insights into loan features and can help you identify the most suitable option, especially if you have bad credit. Remember, how to choose debt consolidation lender depends on your specific financial situation and goals. By thoroughly evaluating each offer, you’ll make an informed decision that aligns with your needs, leading to successful debt consolidation.

Securing the Best Debt Consolidation Deal

Securing the best debt consolidation deal requires a strategic approach. Start by comparing different lenders using debt consolidation loan comparison tools available online. These calculators help assess interest rates, repayment terms, and overall costs associated with various debt consolidation options. Remember, the goal is to find the lowest interest rate possible, which can save you significant amounts in the long run.

In addition to these tools, consider seeking debt consolidation tips from financial experts. They can offer valuable insights into what is debt consolidation and how it works, helping you make informed decisions. Experts can also guide you on managing expectations and choosing a lender that aligns with your financial goals and circumstances.

When considering a debt consolidation loan, understanding the market and comparing offers is key. With low-interest rate loans becoming increasingly accessible, it’s essential to explore options that suit your financial needs. By carefully evaluating terms, interest rates, and repayment conditions, you can secure the best debt consolidation deal. Remember, a thorough debt consolidation loan comparison can help you achieve financial freedom faster.