Unemployment and high debt? Low-interest debt consolidation loans merge multiple debts into one with lower rates, simplifying repayment, alleviating stress, boosting cash flow, and improving credit scores. They offer a fresh start, allowing individuals to clear debts faster and achieve financial stability. Compare lender terms for the best deal based on your situation.

Unemployment and mounting debt can be a formidable combination, but there’s a strategic solution: Low-interest debt consolidation loans. This article guides you through the challenges of unemployment and the benefits of consolidating personal loans and bills. We explore how these loans offer financial breathing room, reduce stress, and simplify repayment. Learn the eligibility criteria, effective strategies for repayment, and take control of your finances with low-interest debt consolidation loans.

- Understanding Unemployment and Debt Struggles

- Benefits of Low-Interest Debt Consolidation Loans

- How to Qualify for Consolidated Loans

- Effective Strategies for Repaying Consolidated Debts

Understanding Unemployment and Debt Struggles

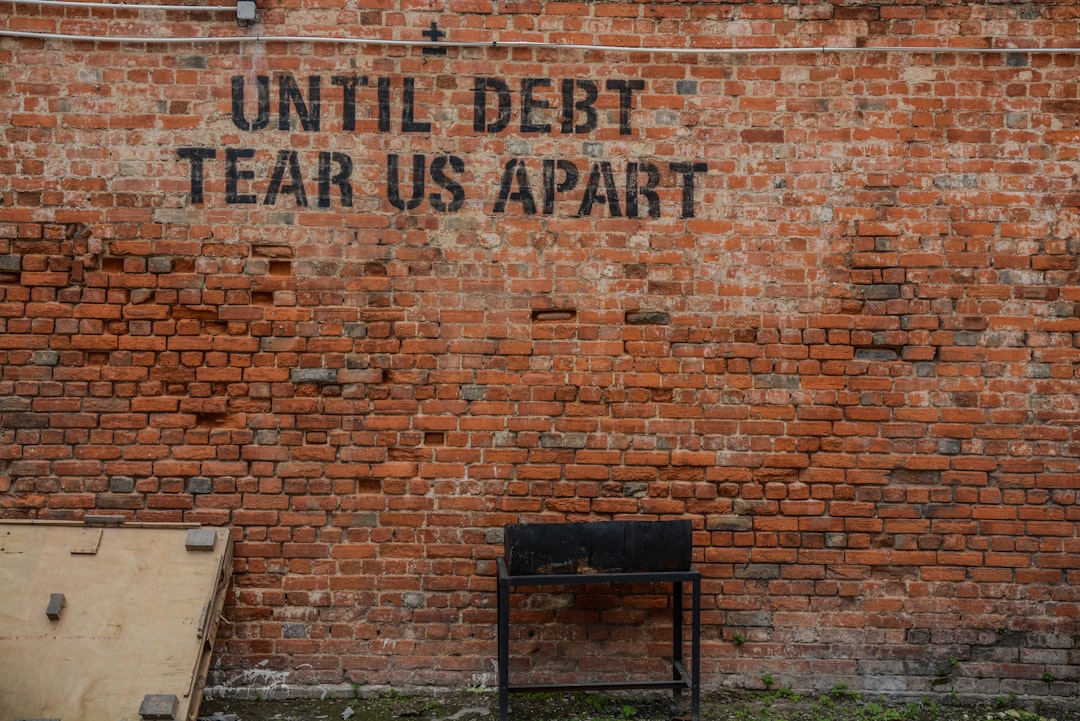

Unemployment can be a devastating blow, leaving individuals facing an array of financial challenges. When job prospects dwindle, many turn to personal loans and credit cards to bridge the gap. Over time, this can lead to a precarious financial situation, with mounting debt and limited income. This is where low-interest debt consolidation loans step in as a potential lifeline.

By consolidating existing debts into a single loan with a lower interest rate, individuals can breathe new life into their finances. This approach simplifies repayment, reduces the burden of multiple payments, and provides some much-needed relief from the stress of debt. It’s an effective strategy to regain control and pave the way for financial stability, especially during uncertain times like unemployment.

Benefits of Low-Interest Debt Consolidation Loans

For individuals struggling with unemployment and a pile of debts, low-interest debt consolidation loans offer a beacon of hope. These loans serve as a strategic tool to simplify financial management by combining multiple high-interest debts into one manageable loan with a significantly lower interest rate. This approach not only eases the burden of frequent repayment dates but also saves money on interest payments over time.

By consolidating debts, borrowers can enjoy enhanced cash flow and improved credit scores. The reduced interest rates allow individuals to pay off their debts faster without being weighed down by excessive interest charges. This financial reprieve enables them to focus on finding employment or generating additional income to further accelerate debt repayment.

How to Qualify for Consolidated Loans

Many individuals struggling with unemployment find themselves burdened by multiple debts, prompting them to seek solutions for debt consolidation. Low-interest debt consolidation loans can be a viable option to simplify repayment and reduce financial stress. To qualify for such loans, borrowers typically need to meet certain criteria set by lenders.

First, applicants should have diverse debt types, such as credit card balances, personal loans, or even past-due bills, that they wish to consolidate under one loan with a lower interest rate. Lenders assess the total amount of debt and compare it against the borrower’s income to determine their ability to repay. Good credit history is advantageous but not always mandatory, as some lenders cater specifically to those with less-than-perfect credit. Demonstrating consistent employment or a stable source of income is crucial for approval, ensuring lenders that repayments can be made on time.

Effective Strategies for Repaying Consolidated Debts

When tackling consolidated debts, a structured approach is key. Start by prioritizing high-interest debts, as paying off these first can save you significant amounts in the long run. This strategic move ensures that your money goes further in reducing overall debt. Additionally, consider the ‘debt snowball’ method, where you pay off the smallest debts first and then work your way up to larger ones. While it might not be the most financially efficient, this approach provides a sense of accomplishment and motivation to stay on track.

Low-interest debt consolidation loans can be a powerful tool in your arsenal. These loans offer a fresh financial start by combining multiple high-interest debts into one manageable loan with a lower interest rate. This streamlines repayment and can free up extra cash each month, allowing you to focus on rebuilding your financial stability. Remember to compare various lenders and their terms to find the best deal suitable for your situation.

Unemployment can exacerbate debt issues, but low-interest debt consolidation loans offer a lifeline. By combining multiple debts into one manageable loan with lower interest rates, individuals can simplify repayment and free up financial resources. Qualifying for these loans requires a careful assessment of one’s financial situation, including credit scores and income stability. Implementing effective strategies for repaying consolidated debts is crucial for long-term financial health and avoiding future financial strain.