UK residents can simplify credit card debt through consolidation loans with lower interest rates and flexible terms. Eligibility requires a stable income and good credit history. Choosing a reputable lender with tailored repayment plans and transparent fees is crucial. Repayment involves budgeting, prioritizing debts using snowball or avalanche methods, and adhering to agreed loan terms to avoid charges and maintain credit score.

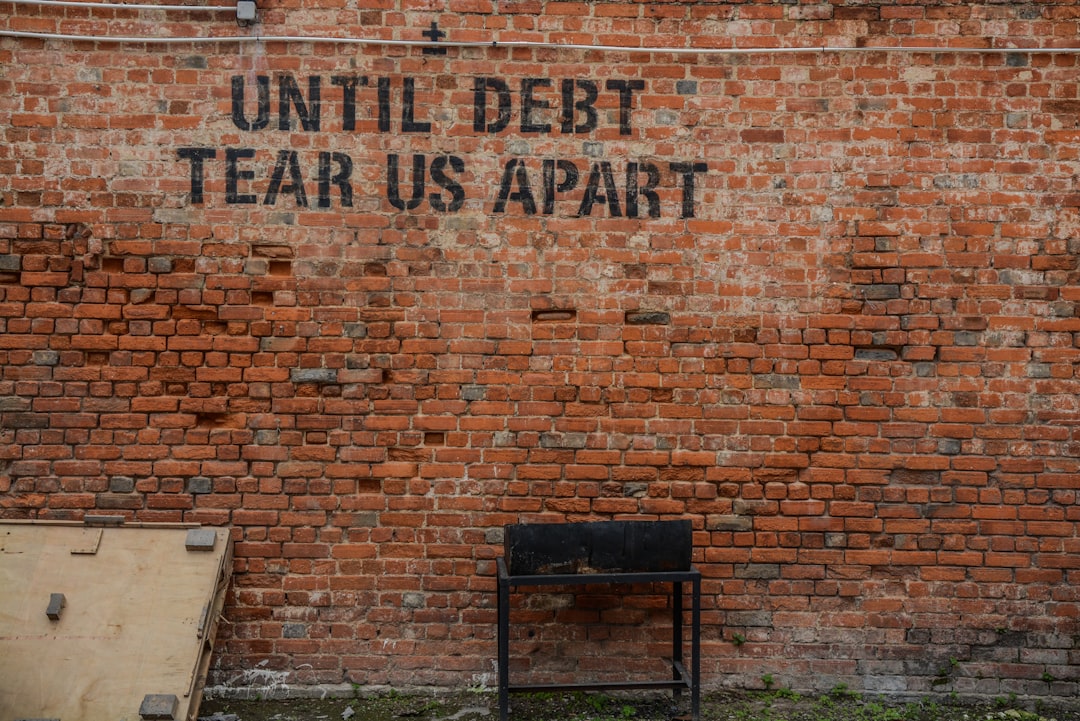

Struggling with multiple credit card debts? Consider Low Interest Debt Consolidation Loans UK, a flexible solution for managing your finances. This article guides you through understanding this option, highlighting its benefits for credit card debt consolidation. We explore eligibility criteria tailored to UK residents and offer tips on choosing lenders with amenable repayment terms. Learn how to simplify your financial burden with well-planned steps towards loan repayment.

- Understanding Low Interest Debt Consolidation Loans UK

- Benefits of Credit Card Debt Consolidation

- Eligibility Criteria for UK Residents

- Choosing the Right Lender with Flexible Terms

- Step-by-Step Guide to Repaying Your Loan

Understanding Low Interest Debt Consolidation Loans UK

Low interest debt consolidation loans in the UK are a popular choice for individuals looking to simplify their finances by combining multiple debts into a single, more manageable loan. This approach, often referred to as credit card debt consolidation, offers several benefits. Firstly, it streamlines repayment schedules, eliminating the need to juggle multiple monthly payments from different creditors. This simplification can significantly reduce stress and make budgeting easier.

Secondly, these loans typically feature flexible repayment terms, allowing borrowers to choose a schedule that aligns with their income and financial goals. As a result, debt consolidation loans can help individuals avoid defaulting on their debts or accumulating further charges due to missed payments. By securing a lower interest rate, borrowers can save money in the long run, making this option an attractive solution for managing credit card debt effectively.

Benefits of Credit Card Debt Consolidation

Debt consolidation is a powerful tool for managing and reducing credit card debt, offering several key advantages. One of the primary benefits is simplified repayment. By combining multiple credit card balances into a single loan with a lower interest rate, individuals can streamline their monthly payments, making them more manageable and easier to budget for. This flexibility allows borrowers to focus on paying off their debt rather than juggling multiple due dates and varying interest charges.

Furthermore, Credit Card Debt Consolidation provides an opportunity to save money in the long run. Lower interest rates mean less expense over time, which is especially beneficial when combined with extended repayment terms. This can result in significant savings compared to continuing to pay off multiple credit cards at their respective rates.

Eligibility Criteria for UK Residents

In the UK, individuals looking to consolidate their credit card debt can access low-interest loans with flexible repayment terms. However, eligibility criteria must be met before applying. Typically, lenders will require applicants to be over 18 years old, have a stable source of income, and possess a good credit history. This is because managing debt responsibly is key in ensuring successful loan repayments.

Credit card debt consolidation loans are particularly appealing as they offer lower interest rates compared to credit cards, allowing borrowers to save on fees. Additionally, flexible repayment options provide relief by spreading out payments over an extended period. This makes it easier for UK residents to manage their finances and reduce the strain of multiple credit card payments.

Choosing the Right Lender with Flexible Terms

When considering a low-interest debt consolidation loan in the UK, selecting the right lender with flexible repayment terms is paramount to your financial success. Look for lenders who offer tailored plans that align with your ability to repay, ensuring you can manage your debt effectively without additional stress. Many reputable lenders provide clear information about their terms and conditions online, allowing you to compare options easily.

Focus on those offering low-interest rates and flexible repayment periods, typically ranging from 3 to 10 years. This gives you the chance to pay off your debt at a steady pace without being burdened by excessive interest charges. Additionally, consider lenders who provide transparent fees and charges, ensuring there are no hidden costs that could compromise your budget.

Step-by-Step Guide to Repaying Your Loan

Repaying your low-interest debt consolidation loan in the UK with flexible terms is a straightforward process. First, assess your financial situation to understand your monthly budget and available funds. This step is crucial for determining how much you can comfortably allocate towards loan repayments each month.

Once you’ve set aside the necessary funds, create a repayment plan. Start by listing all your debts, including the consolidated loan. Prioritise high-interest debts first while making minimum payments on others to stabilise your finances. Then, use the snowball or avalanche method: snowball focuses on paying off debts fastest, while avalanche targets high-interest rates first. Regularly review and adjust your plan as needed. When all debts are settled, focus on making full loan repayments according to the agreed terms to avoid additional charges and ensure a healthy credit score.

Low interest debt consolidation loans offer a viable solution for UK residents looking to manage their credit card debt effectively. By consolidating multiple high-interest payments into one manageable loan with flexible repayment terms, individuals can save money and simplify their financial obligations. With the right lender and a clear understanding of the process, Credit Card Debt Consolidation can be a powerful tool for navigating and overcoming debt in a strategic, budget-friendly manner.