An Unsecured Debt Consolidation Loan for homeowners combines multiple high-interest debts into one lower-rate loan, saving money and simplifying management. While offering flexible terms and improved credit scores, these loans carry risks like default's impact on foreclosure, higher interest rates without collateral, and a lengthy application process. Homeowners must weigh benefits against potential drawbacks to make informed decisions.

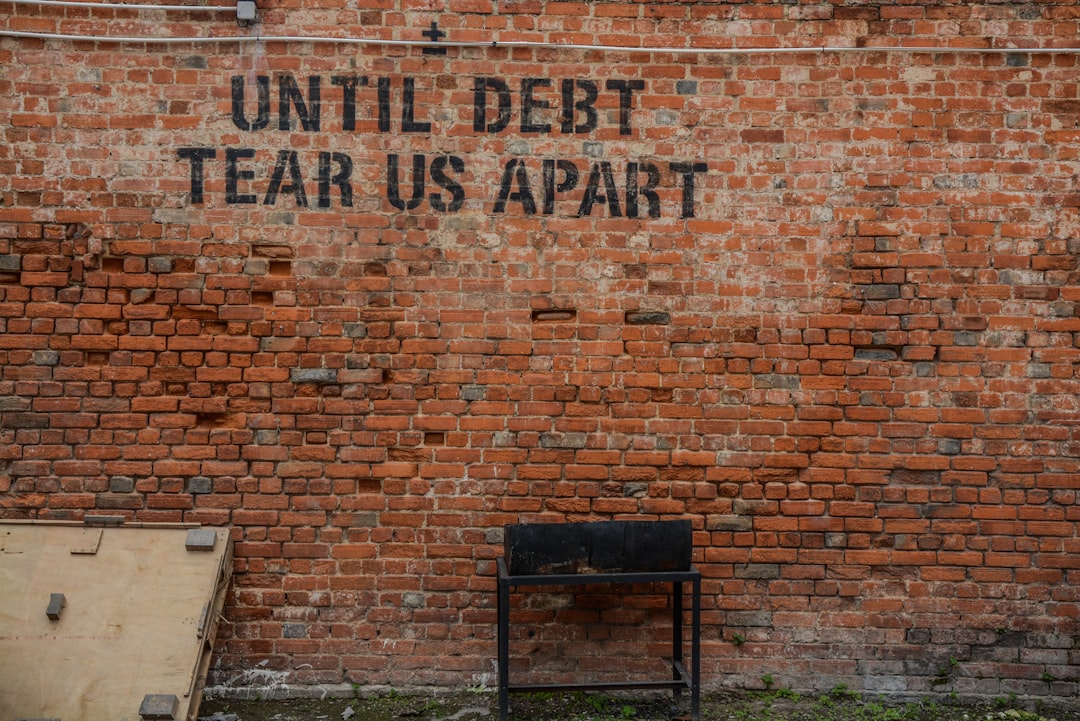

“Considering a Homeowner Consolidation Loan? Unsecured debt consolidation loans offer a potential path to financial freedom by combining multiple debts into one. This article delves into the pros and cons of securing your home for debt relief.

We explore what constitutes an Unsecured Debt Consolidation Loan, highlighting its benefits, such as lower interest rates and simplified payments. However, we also discuss the risks—including potential loss of your home—and challenges to ensure informed decision-making.”

- Understanding Unsecured Debt Consolidation Loans

- Pros: Benefits of Homeowners Consolidating Debt

- Cons: Risks and Challenges of Securing Your Home for Debt Consolidation

Understanding Unsecured Debt Consolidation Loans

An Unsecured Debt Consolidation Loan is a type of financial instrument designed to help homeowners streamline and simplify their debt obligations. Unlike traditional home loans secured by collateral, these loans do not require homeowners to pledge their property as security. This makes them an attractive option for those looking to consolidate high-interest credit card debts, personal loans, or other unsecured debts into a single, more manageable repayment stream.

The primary benefit lies in potential interest savings and improved cash flow management. By consolidating multiple debts into one loan with potentially lower interest rates, homeowners can reduce their monthly payments and pay off their debts faster. This simplicity can alleviate the stress associated with managing multiple lenders and due dates, offering a more straightforward path to financial stability.

Pros: Benefits of Homeowners Consolidating Debt

Homeowners consolidation loans, also known as unsecured debt consolidation loans, offer a range of benefits for those burdened by multiple debts. By combining several high-interest loans into one single loan with a potentially lower interest rate, homeowners can simplify their financial obligations and save money in the long run. This strategic move allows borrowers to focus on repaying one loan instead of many, reducing the administrative burden and stress associated with managing multiple debt payments.

Additionally, unsecured debt consolidation loans often come with flexible repayment terms, making it easier for homeowners to create a budget that suits their financial capabilities. These loans can also help improve credit scores by consolidating debts and demonstrating responsible management of credit, as borrowers are more likely to make on-time payments on one loan than several. This can be particularly advantageous for those looking to access better borrowing opportunities in the future.

Cons: Risks and Challenges of Securing Your Home for Debt Consolidation

When considering a homeowner consolidation loan, it’s crucial to weigh the benefits against the potential risks and challenges. One significant concern is the risk of defaulting on the loan, which can lead to foreclosure if you fail to make payments as agreed. This is especially true for unsecured debt consolidation loans, where there’s no collateral backing the loan, making it a more substantial financial risk for lenders.

Additionally, these loans often come with higher interest rates compared to secured options, as the lack of collateral increases the lender’s exposure. The process of securing a home for debt consolidation can also be lengthy and involves extensive paperwork, appraisals, and credit checks, which might deter individuals seeking a quick solution. Moreover, if property values decrease or there are unexpected financial setbacks, homeowners might find themselves in a more precarious position, with a loan that’s now a larger percentage of their home’s value.

When considering a homeowner consolidation loan, understanding both the benefits and risks is crucial. An unsecured debt consolidation loan can provide financial relief by simplifying payments and potentially lowering interest rates, but it also ties your home’s equity to the debt. Weighing these pros and cons carefully will help you make an informed decision about navigating your debt in the most responsible way. Remember that, in the end, a comprehensive understanding of “what is an unsecured debt consolidation loan” and its implications is key to ensuring a positive financial outcome.