Debt consolidation loans with variable interest rates offer UK students flexible repayment based on market conditions. Lower initial payments during economic downturns and potential higher costs when rates rise. Informed decision-making crucial to manage risks and save money in the long term, especially during periods of economic stability. Compare loan terms carefully to avoid hidden fees.

“Debt consolidation loans can be a powerful tool for managing student debt, especially those with variable rates. This article guides you through the intricacies of these loans, offering insights into their unique advantages in the current financial landscape. We’ll explore how variable rates benefit borrowers, dissect the mechanics behind such loans tailored to students, and compare them to traditional options. Additionally, we’ll discuss management strategies while highlighting benefits and potential drawbacks, empowering students to make informed decisions regarding their debt consolidation journey.”

- Understanding Variable Debt Consolidation Loans

- Advantages of Choosing a Variable Rate

- How These Loans Work for Students

- Comparing Different Loan Options

- Benefits and Potential Drawbacks

- Strategies for Effective Management

Understanding Variable Debt Consolidation Loans

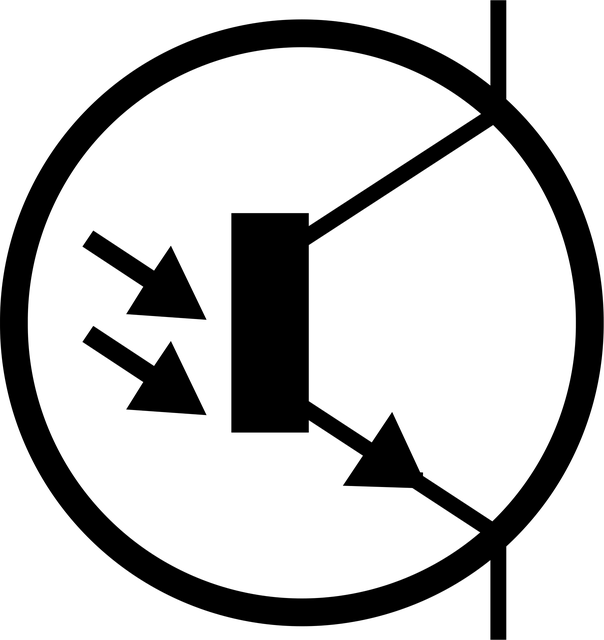

Debt consolidation loans with variable interest rates offer students a flexible repayment option. Unlike fixed-rate loans where the interest stays constant throughout the loan term, variable rates fluctuate based on market conditions. This means your monthly payments can change over time. To understand variable debt consolidation loans fully, it’s crucial to grasp these variable loan terms and conditions.

These loans typically track a benchmark interest rate, such as a Libor index, plus a margin set by the lender. As the base rate changes, so does your loan’s interest rate. This can result in lower monthly payments during economic downturns but potentially higher ones when rates rise. For students looking to refinance debt with a lower variable rate, understanding how do variable rate debt consolidation loans work is key to making an informed decision that aligns with their financial goals.

Advantages of Choosing a Variable Rate

Choosing a debt consolidation loan with a variable interest rate can offer several advantages for students navigating their financial obligations. One significant benefit is the potential for lower initial payments compared to fixed-rate loans. As variable rates fluctuate based on market conditions, borrowers may find themselves with more manageable monthly expenses in the short term. This can be particularly advantageous during student years when income levels might be unpredictable.

Additionally, a variable rate loan can provide flexibility in managing debt. If interest rates decrease over time, so will the borrower’s debt repayment costs. This can be a significant savings opportunity. Understanding that variable interest rates on loans adapt to market trends allows students to make informed decisions about their financial future, especially when considering secure debt consolidation loans with variable rates as a best option during specific periods.

How These Loans Work for Students

Debt consolidation loans for students with variable rates offer a flexible approach to managing student debt in the UK. These loans allow borrowers to combine multiple high-interest debts into one single loan, providing easier repayment and potentially saving money on interest charges. The variable rate means that the interest rate can change over time, which is beneficial when market conditions favour lower rates. Students can benefit from reduced monthly payments during economic downturns, while still enjoying the convenience of having all their debts consolidated in one place.

When considering a variable rate loan, it’s crucial to understand the potential fluctuations in interest rates and how this could impact long-term savings. While these loans offer flexibility and debt help UK students, they may not be suitable for everyone. Understanding when is a variable rate loan best option, such as during periods of economic stability, can help borrowers make informed decisions. Additionally, being vigilant about comparing loan terms and avoiding high fees on variable loans by shopping around for the best rates is essential to getting the most value from this type of consolidation.

Comparing Different Loan Options

When considering debt consolidation loans for students with variable rates, it’s crucial to understand the differences between various options available. One key factor is the interest rate structure—some loans offer a fixed rate, while others are variable, meaning they can fluctuate over time based on market conditions. For students looking to refinance their debt with a lower variable rate, comparing loan terms and conditions becomes essential.

Researching how to negotiate lower variable loan rates can provide significant savings. Variable rate debt consolidation loans may seem appealing due to potentially lower initial interest rates compared to credit card debt, but it’s important to consider the long-term implications. By understanding the factors that influence variable rates and exploring strategies like refinanacing or consolidating debts early, students can make informed decisions that best suit their financial needs and goals.

Benefits and Potential Drawbacks

Debt consolidation loans with variable rates offer a range of benefits for students navigating their financial obligations. One significant advantage is the potential for lower monthly payments, as these loans adjust according to market conditions. This flexibility can be especially beneficial during periods of economic uncertainty or when interest rates fluctuate. Students can also benefit from the convenience of consolidating multiple debts into one, simplifying repayment and reducing the administrative burden.

However, there are potential drawbacks to consider with variable rate debt consolidation loans. The primary concern is the risk of rising interest rates over time, which could increase the overall cost of repayment. Unlike fixed-rate loans that maintain a consistent interest rate throughout, variable rates can change periodically, making it challenging to predict future financial commitments. Furthermore, while lower initial rates may be attractive, students must thoroughly understand the terms and conditions, including potential caps on rate adjustments, to avoid unexpected financial strain in the long term. Getting approved for these loans also requires a good credit standing or a co-signer, which can be a hurdle for some students. Understanding variable interest rates on loans is crucial to making informed decisions and ensuring the best possible outcome when consolidating debt.

Strategies for Effective Management

Managing a variable debt consolidation loan requires a strategic approach to stay in control of your finances and make informed decisions. One key strategy is to understand and track your interest rates. Variable-rate loans can fluctuate, so regularly reviewing your loan terms and comparing them with current market rates is essential. This proactive step allows you to anticipate potential changes and adjust your budget accordingly.

Additionally, creating a detailed repayment plan that aligns with the variable rate structure can be beneficial. By setting aside a specific amount each month, accounting for potential rate increases, you demonstrate discipline and ensure consistent progress towards debt elimination. Remember, while variable rate debt consolidation loans offer flexibility, staying informed and proactive is crucial to managing your loan effectively and avoiding surprises.

Debt consolidation loans with variable rates offer students a flexible yet potentially cost-saving option for managing their education debts. By understanding the benefits of adjustable interest rates and comparing various loan programs, borrowers can make informed decisions to simplify repayment. Effective management strategies ensure that these loans become a powerful tool for financial success rather than a burden. When considering a debt consolidation loan with a variable rate, it’s crucial to weigh the potential savings against the risk of increasing monthly payments in future years.