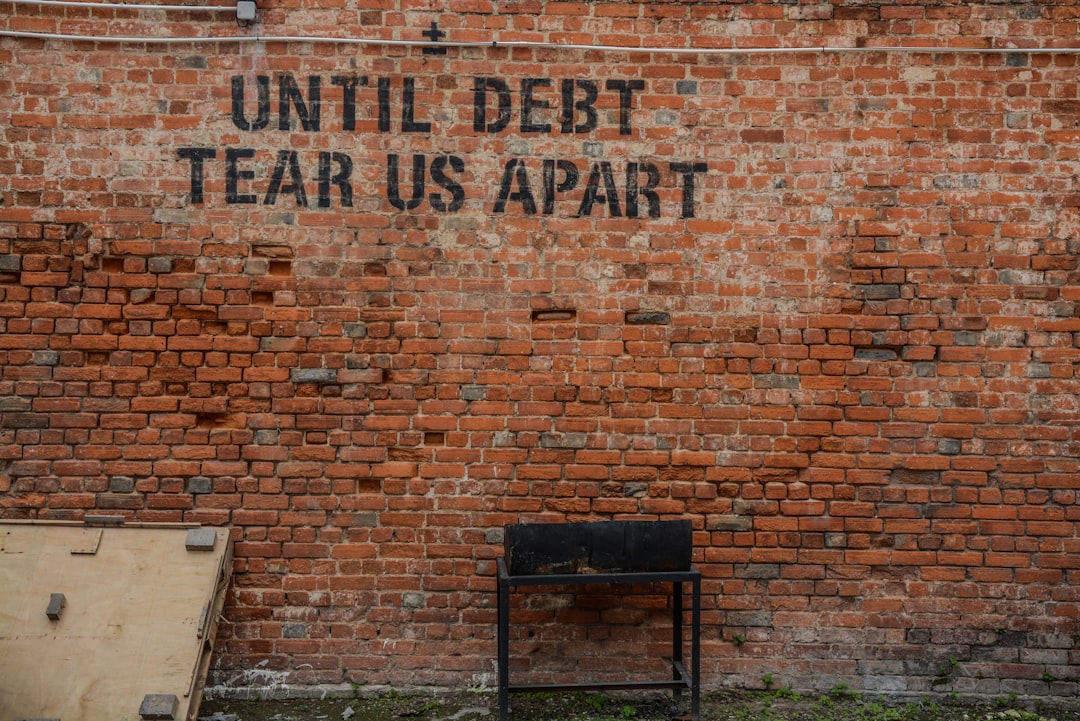

Unsecured consolidation loans streamline debt management by combining multiple high-interest debts into one low-rate loan, offering peace of mind with a single payment, significant interest savings, and simplified budgeting for borrowers with good credit.

Struggling with multiple debts? Explore the power of personal loan consolidation and credit card repayment options. This comprehensive guide delves into unsecured consolidation loans, highlighting their benefits in simplifying your financial burden. Learn how combining multiple debts can lead to lower interest rates and improved management. Discover eligibility criteria and effective strategies for consolidating loans and repaying credit cards under one roof. Take control of your finances today!

- Understanding Unsecured Consolidation Loans

- Benefits of Combining Multiple Debts

- How to Qualify for a Personal Loan Consolidation

- Strategies for Credit Card Repayment with One Loan

Understanding Unsecured Consolidation Loans

Unsecured consolidation loans offer a straightforward and potentially beneficial solution for managing multiple debts. This type of loan allows borrowers to combine various high-interest debt obligations, such as credit card balances, personal loans, or even student loans, into a single, more manageable repayment. The key feature is that these loans don’t require collateral, unlike secured loans that use an asset as guarantee.

This approach can simplify financial management by reducing the number of monthly payments and potentially lowering interest rates, especially if the new loan has a lower APR (Annual Percentage Rate). Borrowers then make one consistent payment each month, which can help avoid missed payments due to juggling multiple deadlines. Unsecured consolidation loans are particularly appealing for those seeking debt relief without having to part with any assets as security.

Benefits of Combining Multiple Debts

Combining multiple debts into one loan, often facilitated by unsecured consolidation loans, offers several significant advantages for borrowers. Firstly, it simplifies repayment processes by consolidating various debt obligations into a single, manageable payment schedule. This streamlines budgeting and ensures consistent debt management, eliminating the hassle of tracking multiple due dates and varying interest rates.

Secondly, such loan options can result in substantial savings on interest charges. When several loans are combined, the overall interest cost is reduced as the lender’s focus shifts to offering a lower, unified rate for the consolidated amount. This financial burden reduction can free up cash flow, allowing borrowers to better address other financial commitments or even invest in opportunities that foster long-term growth and stability.

How to Qualify for a Personal Loan Consolidation

To qualify for an unsecured consolidation loan, individuals must first meet certain criteria set by lenders. Generally, this includes having a good to excellent credit score, demonstrating stable income, and providing proof of employment. Lenders prefer borrowers with a solid financial history as it reduces the risk associated with offering such loans without collateral.

Additionally, lenders may assess your existing debts, checking the types and amounts owed. This step is crucial in determining the loan amount and interest rates offered. The goal is to consolidate multiple high-interest debt obligations into one manageable payment at a potentially lower rate, saving you money over time.

Strategies for Credit Card Repayment with One Loan

Many individuals struggling with multiple credit card debts often find themselves seeking effective repayment strategies. One powerful solution is through unsecured consolidation loans, which provide a unified approach to settling various card balances. By combining several cards into a single loan, borrowers can simplify their repayment process and potentially reduce interest rates, leading to significant savings over time.

This method allows for better management of debt by consolidating high-interest credit card debts into one manageable payment. Borrowers can then focus on paying off the consolidated loan at a potentially lower rate, thereby eliminating the stress of multiple due dates and varying interest charges. Unsecured consolidation loans offer a straightforward path to financial stability, making it easier to stay on track with repayment and avoid the pitfalls of accumulating more debt.

Personal Loan Consolidation offers a strategic approach to managing multiple debts, especially through unsecured consolidation loans. By combining credit card debts and other loan obligations into a single repayment stream, individuals can simplify their financial lives and potentially save on interest costs. This article has explored the benefits of this method, from enhanced cash flow management to improved credit score potential. With careful consideration and strategic planning, personal loan consolidation could be the key to achieving financial freedom and peace of mind.