Joint Debt Consolidation Loans help married couples manage multiple debts, especially Bad Credit Debt Consolidation Loans, by reducing interest rates and simplifying payments. This collaborative approach saves money, shortens repayment periods, and rebuilds financial stability for a more sustainable budget. Secured loans with collateral, government programs for low-income households, and non-profit counseling offer options to regain control, with tailored consolidation programs available through counseling agencies.

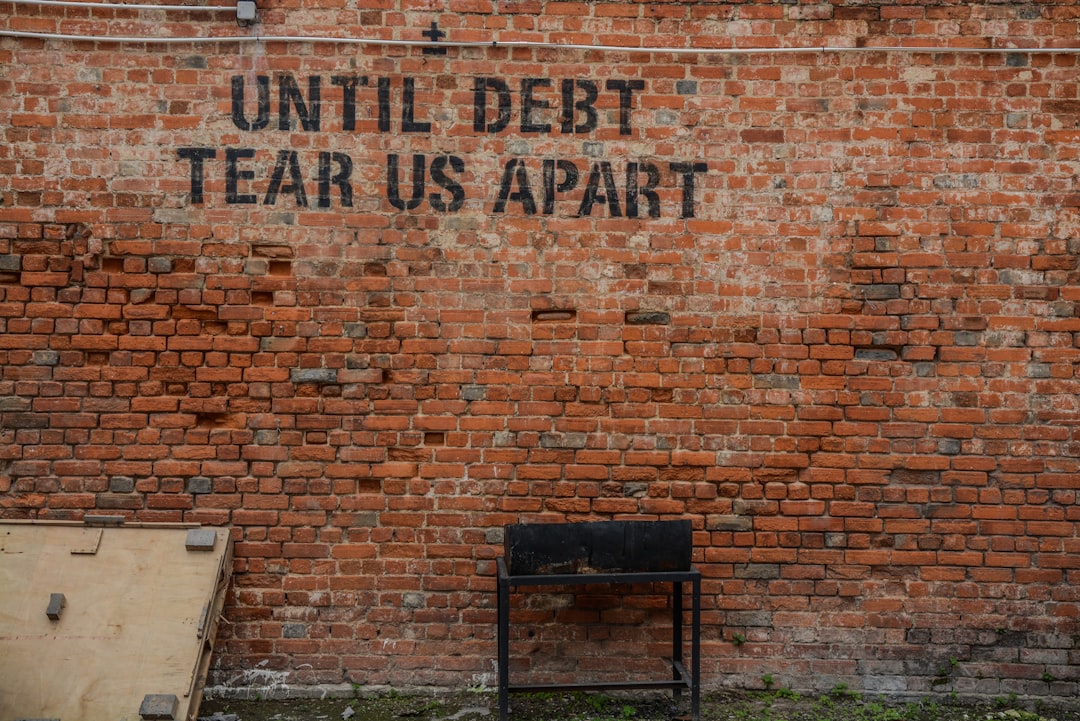

For married couples facing financial challenges, managing multiple debts can feel overwhelming. In such scenarios, joint debt consolidation loans with one income offer a potential lifeline. This article explores the concept of bad credit debt consolidation loans tailored for these unique circumstances. We’ll delve into how these loans work, highlighting their benefits and addressing concerns about low credit scores. Understanding this option could be the first step toward financial freedom.

- Understanding Joint Debt Consolidation Loans

- Bad Credit Debt Consolidation Options for Married Couples with One Income

Understanding Joint Debt Consolidation Loans

Joint Debt Consolidation Loans are a strategic financial move for married couples aiming to streamline their debt with a single, more manageable payment. This type of loan allows both partners to be jointly responsible for repaying the debt, which can significantly reduce interest rates and simplify the repayment process. It’s particularly beneficial for those with Bad Credit Debt Consolidation Loans, as it offers an opportunity to rebuild financial stability together.

By combining multiple debts into one, couples can save money on interest charges and potentially shorten their repayment period. This collaborative approach ensures that both partners are invested in their financial future, fostering a sense of shared responsibility. It’s an effective way to gain control over debt and create a more sustainable budget for the long term.

Bad Credit Debt Consolidation Options for Married Couples with One Income

For married couples facing debt with a single source of income, finding suitable bad credit debt consolidation loans can seem daunting. However, several options are available to help them regain financial control. One popular choice is secured loan consolidation, where the couple uses an asset, like their home or car, as collateral. This approach often results in lower interest rates compared to unsecured loans, making it a viable option despite bad credit.

Another alternative is exploring government-backed programs designed for low-income households. These programs offer specialized bad credit debt consolidation loans with flexible terms and potentially lower interest rates. Additionally, non-profit financial counseling agencies can provide guidance on managing debt and may connect couples to suitable consolidation programs tailored to their unique circumstances.

For married couples facing financial challenges with one primary income, exploring Bad Credit Debt Consolidation Loans can be a strategic move towards economic stability. By joining forces and utilizing these specialized loans, partners can collaborate in managing debt more effectively. This approach not only simplifies repayment but also strengthens their financial future together, offering a clearer path to overcoming financial obstacles as a united front.