Unsecured Consolidation Loans streamline debt management by combining multiple loans with potentially lower interest rates, simplifying repayment and reducing burden for borrowers with good credit scores. They offer flexible criteria, faster approvals, and competitive rates compared to traditional methods like credit cards or personal loans.

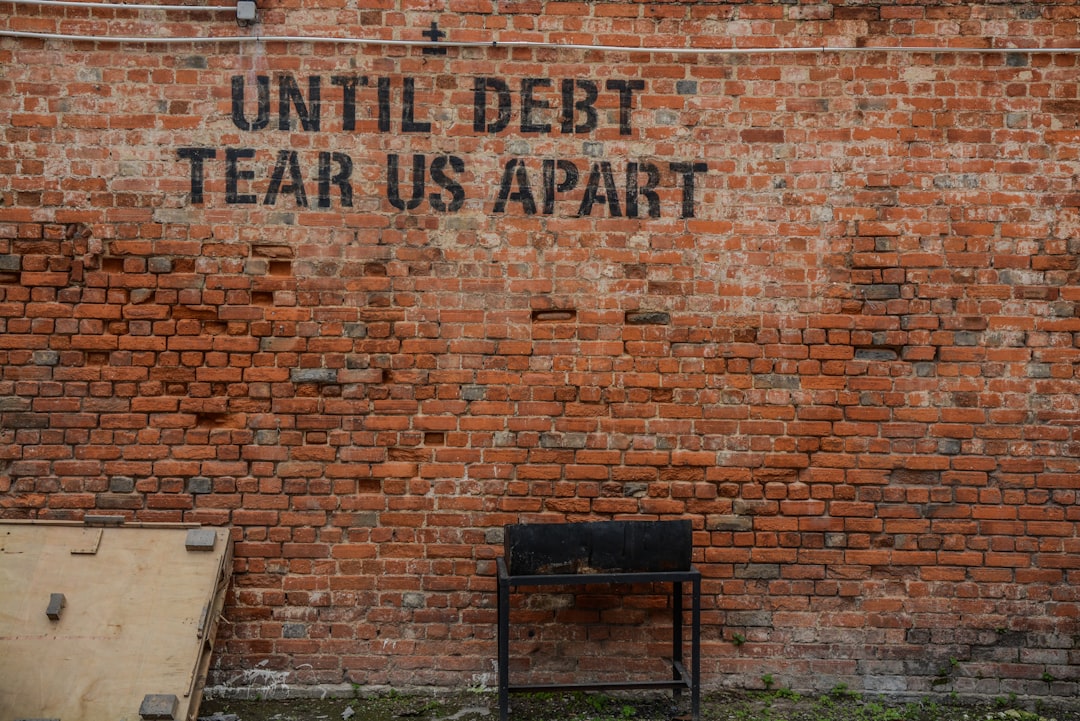

Struggling with multiple debts? Explore the world of debt consolidation loans, a powerful tool for financial relief. This article delves into the two primary types: secured and unsecured. Understanding their nuances is key to making an informed decision. We break down the benefits and considerations of each, focusing on unsecured consolidation loans as a popular, low-risk option. By comparing them with traditional methods, you’ll gain insights to choose the best path towards financial freedom.

- Understanding Secured and Unsecured Debt Consolidation Loans

- Comparing Options: Unsecured Consolidation Loans vs Traditional Methods

Understanding Secured and Unsecured Debt Consolidation Loans

Debt consolidation is a popular strategy for managing multiple debts by combining them into one loan with potentially lower interest rates. This simplifies repayment, making it easier to budget and reduce overall debt burden. The two primary types of consolidation loans are secured and unsecured. Unsecured consolidation loans are a popular choice as they don’t require collateral, making them more accessible. Applicants with good credit scores often qualify for these loans, offering competitive interest rates.

Unlike secured loans, which use an asset like a house or car as guarantee, unsecured loans rely on the borrower’s creditworthiness. This means there’s no risk to a lender if the borrower defaults, but it also means lenders may charge slightly higher rates to compensate for the increased risk. Unsecured consolidation loans are suitable for those looking to simplify debt repayment without putting up collateral, aiming to save money and improve financial health.

Comparing Options: Unsecured Consolidation Loans vs Traditional Methods

When considering debt consolidation, it’s crucial to weigh the benefits of unsecured consolidation loans against traditional methods. Unlike secured loans that require collateral, unsecured options provide a more flexible approach with no asset at risk. This makes them an attractive choice for those seeking a hassle-free solution without compromising their assets.

Unsecured consolidation loans often come with simpler qualification criteria and faster approval times. They are particularly advantageous for individuals with good credit, allowing them to consolidate various debts into a single manageable payment with potentially lower interest rates. In contrast, traditional methods like credit card balances or personal loans may offer less favorable terms and could lead to cycles of high-interest payments and poor financial management.

When deciding between unsecured consolidation loans and traditional methods, evaluating your financial situation and priorities is key. Unsecured consolidation loans offer a simple, less restrictive option for debt relief, making them appealing for those seeking flexibility. However, traditional approaches may be more suitable for addressing specific debts or building credit history. Ultimately, the best choice depends on individual needs, with unsecured consolidation loans standing out for their accessibility and potential to simplify repayment.