Debt Consolidation Loans for Married Couples offer a strategic financial solution by simplifying multiple payments into one manageable loan, reducing monthly expenses and stress. These loans cater to couples with varying credit histories, provide flexible terms including lower interest rates and extended repayment periods, and can be accessed without a thorough credit check. Eligibility requires proof of employment, stable income, joint credit history, and minimum credit scores. The application process involves five key steps: assess financial situation, research lenders, gather documents, fill out the application, and wait for approval. Strategies to enhance approval chances include improving joint credit scores and comparing lenders extensively.

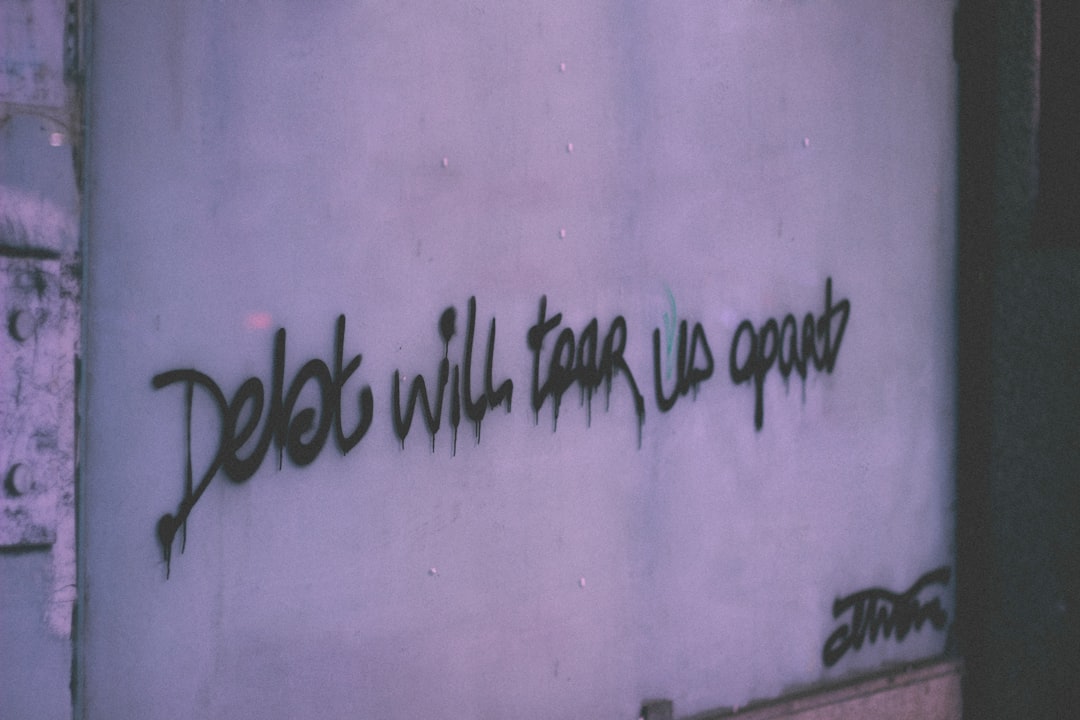

“Struggling with multiple debts and seeking a solution? Debt consolidation loans offer a potential path to financial freedom, especially for married couples. This comprehensive guide explores how Debt Consolidation Loans for Married Couples can simplify finances. We’ll delve into the benefits, eligibility criteria, and application process, focusing on securing favorable terms without the need for a credit check. By understanding these aspects, you can take control of your debt and make informed decisions.”

- Understanding Debt Consolidation Loans for Married Couples

- Benefits of Debt Consolidation: A Comprehensive Look

- No Credit Check Requirements: What It Means for Borrowers

- Eligibility Criteria for Debt Consolidation Loans

- The Application Process: Step-by-Step Guide

- Tips for Securing the Best Debt Consolidation Loan Terms

Understanding Debt Consolidation Loans for Married Couples

Debt Consolidation Loans for Married Couples offer a strategic financial solution for joint debts, enabling partners to streamline multiple payments into one manageable loan. This simplified approach can significantly reduce monthly expenses and alleviate the stress associated with managing separate loans. By consolidating their debts, married couples can focus on making consistent payments towards a single, often lower interest rate loan.

These loans are designed to cater to the unique financial circumstances of married individuals, recognizing that shared responsibilities necessitate tailored strategies. Unlike traditional loans that may require extensive credit checks, Debt Consolidation Loans for Married Couples often operate with more flexible criteria, allowing couples to access funding despite varying credit histories. This makes them an attractive option for those looking to gain control over their finances and consolidate their debts in a way that suits their marital status.

Benefits of Debt Consolidation: A Comprehensive Look

Debt consolidation offers several significant advantages, especially for married couples seeking financial stability. One of the primary benefits is the simplification of repayment processes. By combining multiple debts into a single loan with a lower interest rate, couples can streamline their monthly payments and budget more effectively. This clarity in financial obligations can alleviate stress and improve cash flow, allowing them to focus on other aspects of their lives.

Additionally, debt consolidation loans for married couples often provide better terms and conditions compared to individual loans. Lenders understand that shared financial responsibilities strengthen a couple’s financial standing. As a result, they may offer more competitive interest rates, extended repayment periods, and the flexibility to choose loan structures that suit both partners’ needs. This collaborative approach can lead to significant savings over time and empower couples to take control of their finances together.

No Credit Check Requirements: What It Means for Borrowers

When considering debt consolidation loans, one of the most appealing aspects is the potential to access financing without a thorough credit check. This is particularly beneficial for married couples or individuals who may have faced financial challenges in the past and are now looking to rebuild their credit standing. No credit check requirements mean lenders focus less on your credit score and more on your ability to repay the loan, making it an attractive option for those seeking Debt Consolidation Loans for Married Couples.

Without the need for extensive credit verification, borrowers can increase their chances of approval and gain access to better interest rates. This is especially true for couples who can pool their income and assets, providing lenders with a more comprehensive financial picture. As a result, they may qualify for larger loan amounts or more favorable terms, helping them consolidate debts effectively while improving their overall financial health over time.

Eligibility Criteria for Debt Consolidation Loans

Many financial institutions offer debt consolidation loans, but not all applicants will qualify. Lenders typically assess applicants’ creditworthiness and financial stability before offering such loans. For married couples seeking Debt Consolidation Loans, meeting certain eligibility criteria is essential. Firstly, both partners need to have a stable income and a joint credit history. Lenders often require proof of employment and regular income streams to ensure repayment capability. Additionally, maintaining a minimum credit score is crucial; although requirements vary, a higher score increases the chances of approval.

It’s important to remember that these loans are a significant financial commitment, so lenders will assess the overall debt-to-income ratio. Married couples should demonstrate responsible borrowing and spending habits and provide transparent financial information to increase their chances of securing a Debt Consolidation Loan with favorable terms.

The Application Process: Step-by-Step Guide

Applying for a debt consolidation loan with no credit check is a straightforward process, especially for married couples looking to streamline their finances. Here’s a step-by-step guide to help you navigate the application journey.

1. Assess Your Financial Situation: Begin by evaluating your current financial obligations and income. Calculate your total monthly expenses, including all debts, and determine how much you can realistically afford to borrow without causing strain on your budget. Debt consolidation loans are designed to simplify repayment, so understanding your finances is key.

2. Research Lenders: Look for reputable lenders who specialize in debt consolidation loans with no credit check. As a married couple, you have the advantage of potentially qualifying for joint loans, which often offer better terms. Compare interest rates, loan amounts, and repayment periods to find the best option for your needs. Online reviews can be invaluable in identifying trustworthy lenders.

3. Gather Required Documents: Lenders will typically require identification documents such as government-issued IDs and proof of income. For married couples, additional documentation may include tax returns, bank statements, and proof of employment for both partners. Ensure these documents are up to date and easily accessible.

4. Complete the Application Form: Fill out the loan application form accurately and honestly. Provide details about your current debts, including amounts and interest rates. Be transparent about your income and any assets you own. Some lenders may perform soft credit checks, which won’t affect your score, to verify the information provided.

5. Submit and Wait for Approval: Once your application is complete, submit it to the chosen lender. They will review your details and make a decision based on their criteria. Approvals can vary in time, but many lenders aim to provide quick responses. If approved, you’ll receive loan terms and conditions to review before final acceptance.

Tips for Securing the Best Debt Consolidation Loan Terms

When exploring debt consolidation loans with no credit check, specifically for married couples, there are several strategies to employ to secure favorable loan terms. Firstly, compare lenders extensively to find those offering competitive rates and flexible repayment options tailored to your needs. Many reputable online platforms facilitate this process by providing side-by-side comparisons. Additionally, focus on lenders who specialize in debt consolidation loans; they often have a deeper understanding of the unique financial challenges married couples face.

Another key tip is to enhance your chances of approval by improving your credit scores collectively. Although individual credit checks may be performed, a strong joint credit history can significantly boost your application’s success. Consider making timely payments on shared expenses and building a consistent payment history. Furthermore, keeping debt levels low relative to available credit will positively impact your credit utilization ratio, a factor lenders scrutinize closely.

Debt Consolidation Loans for Married Couples offer a viable path to financial stability, especially with the right guidance. By understanding the benefits, eligibility criteria, and application process, couples can navigate the market effectively. Remember that while “no credit check” loans seem appealing, they may come with higher interest rates. Following the tips provided, borrowers can secure favourable terms, making debt consolidation a powerful tool for managing finances and achieving long-term financial goals.