Personal Loan Consolidation simplifies debt management by merging multiple loans into one with potentially lower interest rates. Debt Consolidation Loans With No Credit Check offer an alternative for individuals with credit issues, assessing applicants based on income and bank statements instead of credit scores. These loans streamline budgeting, reduce missed payments, and save money over time. By evaluating obligations, researching lenders, comparing loan terms, and maintaining transparency, individuals can access these loans to gain financial control. Debt consolidation is a strategic solution for high-interest credit card debt, making it accessible to a wider range of borrowers.

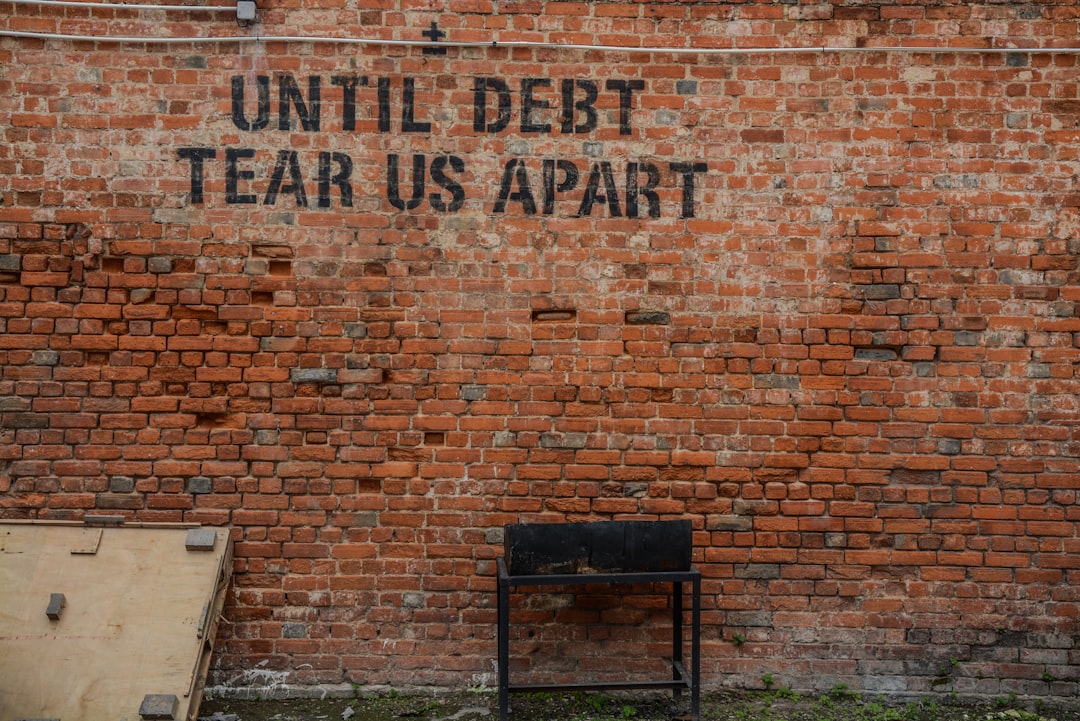

Struggling with multiple debts? Explore the power of personal loan consolidation, a strategic approach to streamline your financial obligations. This article delves into the benefits of combining credit card balances and loans into one manageable repayment, offering clarity in complex debt management.

Discover ‘Debt Consolidation Loans With No Credit Check’ as a viable option for those seeking relief without rigorous scrutiny. Learn about the advantages, from simplified payments to potential interest savings, and gain insights into every step of the application process. Real-life success stories inspire, demonstrating how consolidation can transform debt into achievable financial goals.

- Understanding Personal Loan Consolidation: A Simple Approach to Debt Management

- No Credit Check Loans: How They Work and Their Benefits for Borrowers

- The Advantages of Combining Multiple Debts into One Loan

- Step-by-Step Guide: Applying for a Debt Consolidation Loan with Ease

- Credit Card Repayment Strategies: Reducing Interest Charges and Balances

- Real-Life Success Stories: Transforming Debt into Manageable Financial Goals

Understanding Personal Loan Consolidation: A Simple Approach to Debt Management

Personal Loan Consolidation offers a straightforward solution for managing debt, especially for those burdened by multiple loans and credit card payments. This process involves combining several debts into one comprehensive loan, simplifying repayment and potentially lowering interest rates. It’s an attractive option for individuals seeking relief from the stress of juggling multiple financial obligations.

Debt Consolidation Loans With No Credit Check provide a fresh start to borrowers who may have struggled with traditional lending due to credit issues. By consolidating debts, individuals can streamline their payments, making it easier to stay on top of their finances. This approach not only simplifies debt management but also empowers borrowers by offering a clear path to financial stability and reduced long-term costs.

No Credit Check Loans: How They Work and Their Benefits for Borrowers

No credit check loans, also known as alternative or non-traditional financing options, have gained popularity among borrowers seeking debt consolidation and repayment solutions. These loans operate differently from conventional loans that require a thorough credit check. Instead, lenders consider other factors to assess an applicant’s ability to repay, such as income, employment history, and bank statements. This approach is particularly beneficial for individuals with poor or limited credit histories, who might otherwise struggle to obtain approval for traditional loans.

One of the primary advantages of debt consolidation loans with no credit check is their accessibility. Borrowers can often secure funding more quickly without the lengthy application process and potential rejections associated with conventional loans. This can be especially useful when individuals need immediate financial assistance to consolidate multiple debts or repay high-interest credit cards. Additionally, these loans may offer competitive interest rates, helping borrowers save money in the long run and providing them with a clearer path towards financial stability.

The Advantages of Combining Multiple Debts into One Loan

Combining multiple debts into one loan, often through a debt consolidation loan with no credit check, offers several advantages for individuals struggling with various repayment obligations. Firstly, it simplifies the repayment process, transforming multiple bills and due dates into a single, manageable payment. This streamlines budgeting and reduces the risk of missed payments caused by juggling multiple debts.

Moreover, debt consolidation loans can help lower overall interest rates paid over time. When multiple high-interest debts are combined, the loan balance may be spread across a longer term, resulting in smaller monthly payments and saving money on interest charges. This can free up cash flow for other financial needs or discretionary spending, enhancing overall financial well-being.

Step-by-Step Guide: Applying for a Debt Consolidation Loan with Ease

Applying for a debt consolidation loan with no credit check can seem daunting, but it’s simpler than you think. Here’s a step-by-step guide to navigating this process smoothly. First, assess your financial situation and calculate the total amount you owe across all debts. Next, research lenders who offer debt consolidation loans without stringent credit checks. Many online lenders specialize in this area, providing accessibility and flexibility.

Once you’ve identified potential lenders, compare their interest rates, loan terms, and any associated fees. Choose a lender that aligns with your financial goals and budget. Afterward, gather necessary documents like proof of income and identity. Complete the loan application accurately and honestly to expedite approval. With these steps, you’ll be well on your way to consolidating your debts into a single, manageable loan.

Credit Card Repayment Strategies: Reducing Interest Charges and Balances

Many people struggle with high-interest credit card debt, but there’s a light at the end of the tunnel through debt consolidation loans. One of the primary benefits is the potential to significantly reduce interest charges. When you consolidate credit card debt into a single loan, you’re often given a lower, fixed interest rate. This can save you money in the long run by keeping your monthly payments consistent while reducing the overall cost of borrowing.

Additionally, consolidating credit card balances allows you to focus on paying down your debt more efficiently. By combining multiple cards into one with a lower interest rate, you can direct all your repayment efforts towards the loan instead of scattered across various cards. This strategic approach helps you eliminate balances faster and gain control over your finances. Moreover, some debt consolidation loans offer no credit check options, making them accessible to a wider range of individuals looking to alleviate their credit card debt burden.

Real-Life Success Stories: Transforming Debt into Manageable Financial Goals

Many individuals find themselves burdened by multiple debts, with credit cards and personal loans accumulating over time. This can lead to a sense of being overwhelmed and trapped in a cycle of repayment. However, there’s hope for financial freedom through debt consolidation. Real-life success stories abound of those who have transformed their daunting debt into manageable financial goals.

Debt Consolidation Loans With No Credit Check offer a fresh start by combining multiple debts into one loan with potentially lower interest rates and more flexible terms. This not only simplifies repayment but also saves money on interest charges. For instance, consider Sarah, who had several credit cards and a personal loan, each with varying interest rates. Through debt consolidation, she was able to reduce her monthly payments significantly and pay off her debts in half the time—all without a thorough credit check holding her back.

Debt consolidation loans, especially those available with no credit check, offer a viable solution for managing multiple debts. By combining various loans and credit card balances into one comprehensive repayment plan, individuals can simplify their financial obligations and potentially save on interest charges. This article has guided readers through the process, from understanding personal loan consolidation to implementing effective credit card repayment strategies. With the right approach, transforming debt into manageable financial goals is within reach, empowering folks to take control of their finances and forge a path toward financial freedom.