Personal Loans for Debt Consolidation offer a strategic solution to manage multiple debts by combining them into a single fixed-rate loan. This approach simplifies repayment with one monthly payment, saves on interest payments, and provides lower rates than credit cards. A 10K Debt Consolidation Loan helps individuals grappling with multiple debts gain financial control and ease the burden of juggling multiple payment due dates.

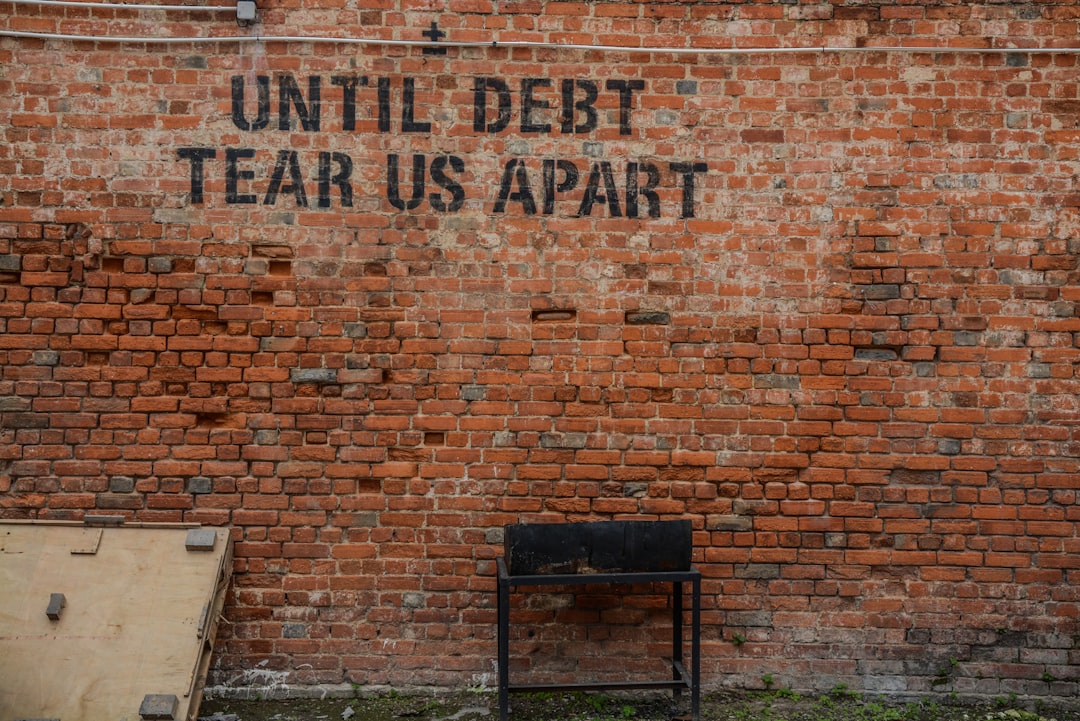

“Consider a 10K Debt Consolidation Loan as your path to financial freedom. This article explores the transformative power of personal loans for debt consolidation, unveiling how they can simplify and streamline your finances. By consolidating multiple debts into one manageable payment, you gain clarity and control over your money.

Discover the advantages of debt consolidation and understand how a 10K loan can be a strategic move to reduce interest rates, simplify repayment, and free up funds for other priorities.”

- Understanding Debt Consolidation and Its Advantages

- How a 10K Debt Consolidation Loan Can Transform Your Financial Situation

Understanding Debt Consolidation and Its Advantages

Debt consolidation is a strategic approach where individuals combine multiple debts into a single loan, typically with a lower interest rate and more manageable terms. This process simplifies repayment by consolidating various debt obligations into one fixed-rate personal loan for debt consolidation. The primary advantages lie in its ability to offer better financial management and potentially save on interest payments over time.

By consolidating debts, borrowers can say goodbye to the hassle of multiple monthly payments. Instead of tracking several due dates, they make just one repayment, which can be scheduled according to their convenience. This simplicity is particularly appealing for individuals who find themselves overwhelmed by the sheer number of bills they need to pay each month. Moreover, personal loans for debt consolidation often come with lower interest rates compared to credit cards, helping borrowers save money in the long run.

How a 10K Debt Consolidation Loan Can Transform Your Financial Situation

A 10K Debt Consolidation Loan can be a game-changer for individuals struggling with multiple debts. By combining all your outstanding balances into one single loan, this strategy offers several significant advantages that can transform your financial situation. No longer will you have to juggle multiple payment due dates and varying interest rates; instead, you’ll make just one monthly repayment at a potentially lower interest rate than your current debts allow. This simplicity not only eases the burden of management but also saves money in the long run by minimizing the interest you pay over time.

Moreover, personal loans for debt consolidation can provide much-needed breathing room. With a consolidated loan, you may have more flexibility to manage your budget as you see fit. This could mean paying off debts faster or allocating funds to other essential expenses. Ultimately, this loan is about reclaiming control of your finances and paving the way for a brighter, debt-free future.

A $10,000 debt consolidation loan can be a powerful tool for financial reset. By combining multiple high-interest debts into one manageable payment, this strategy simplifies budgeting and saves money through lower interest rates. Whether you’re burdened by credit card debt, personal loans, or other types of unsecured borrowing, exploring a personal loan for debt consolidation could be a smart step towards reclaiming control over your finances and securing a brighter financial future.