When seeking UK Credit Card Debt Consolidation for bad credit, understanding lender criteria is key. While past financial issues can be a hurdle, some lenders focus on current stability and employment. Specialised providers may skip extensive credit checks. To secure the best deal, compare loan offers based on interest rates, terms, and fees. Unsecured debt consolidation loans simplify multiple debts but carry risks like less favorable terms and higher interest rates. Borrowers must implement realistic repayment plans with professional guidance to make informed decisions.

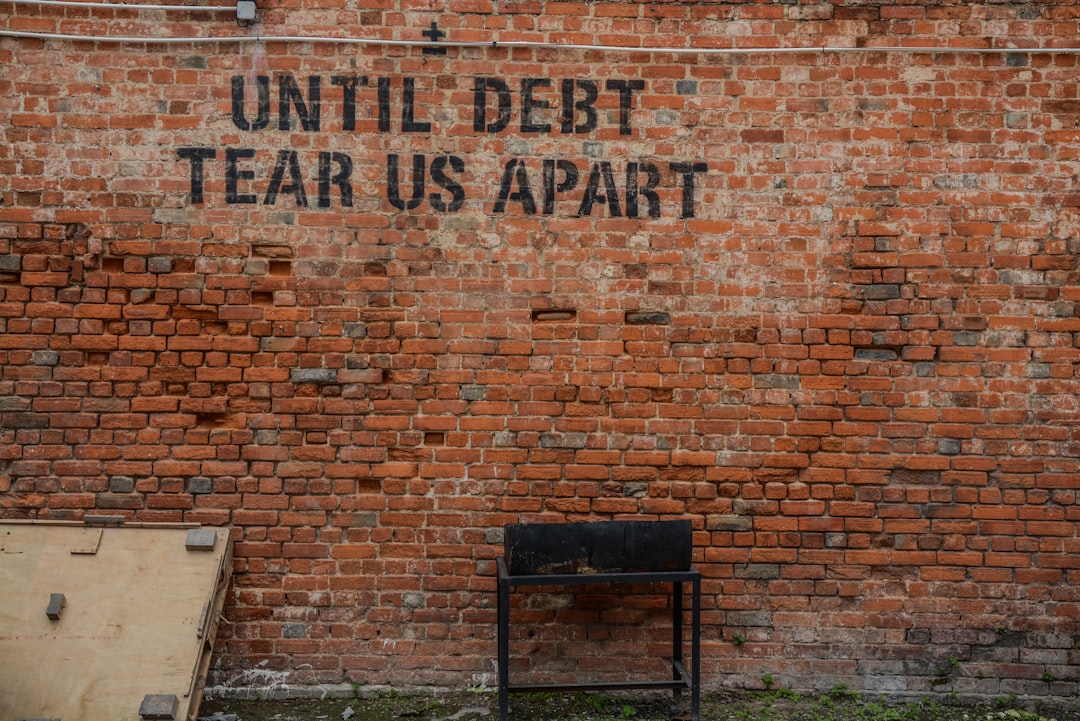

“Struggling with multiple credit card debts in the UK? Unsecured Debt Consolidation Loans could be a viable solution, even for those with bad credit or no credit history. This comprehensive guide explores how these loans work in the UK, focusing on options without rigorous credit checks. We’ll delve into eligibility criteria, the application process, and the potential benefits and risks involved. Understanding Credit Card Debt Consolidation is key to making informed decisions about your financial future.”

- Understanding Unsecured Debt Consolidation Loans in the UK

- Eligibility Criteria for Bad Credit Applicants

- The Process of Securing a Loan with No Credit Check

- Potential Benefits and Risks: What You Need to Know

Understanding Unsecured Debt Consolidation Loans in the UK

Unsecured debt consolidation loans are a popular option for individuals in the UK looking to simplify their financial obligations, especially those with bad credit or no credit history. This type of loan involves combining multiple debts into one single repayment, making it easier to manage and potentially reducing overall interest costs. The beauty of unsecured debt consolidation loans lies in their accessibility; they don’t require any collateral, which is ideal for those without assets to offer as security.

In the UK, many lenders provide these loans with flexible terms and rates, catering to various borrower needs. Credit card debt consolidation is a primary use case, where individuals can pay off multiple credit cards with high-interest rates in one go, saving money on interest charges. This strategy allows borrowers to focus on a single repayment schedule, streamlining their financial life and potentially improving their credit score over time.

Eligibility Criteria for Bad Credit Applicants

When considering credit card debt consolidation for bad credit in the UK, it’s important to understand that lenders will have specific eligibility criteria in place. Applicants with a history of missed payments, high debt-to-income ratios, or previous insolvencies may face challenges when applying for loans. However, not all options are closed. Lenders offering unsecured debt consolidation loans often consider an individual’s current financial situation and employment status more than their past credit performance. This means that while a bad credit history can hinder access to traditional loans, it might not always be a deal-breaker.

Bad credit applicants should look for lenders who provide flexibility in their assessment process. Some specialised lenders and credit unions offer loans without a thorough credit check, focusing instead on an applicant’s ability to repay. These alternatives can be beneficial for those with limited credit history or recent negative markings on their report. It’s advisable to compare offers from various lenders, considering interest rates, repayment terms, and any associated fees to find the most suitable debt consolidation loan for bad credit in the UK.

The Process of Securing a Loan with No Credit Check

When exploring unsecured debt consolidation loans UK options, individuals with a poor credit history often face challenges. However, many lenders now offer loans with no credit check, providing an alternative route to managing credit card debt consolidation. This process involves a straightforward application method where lenders base their decision primarily on your current financial situation and ability to repay, rather than relying solely on your credit score.

Lenders will typically request recent bank statements and proof of identification to assess your affordability. They may also consider factors like employment status and regular income to determine if you can handle the loan repayments. This approach ensures that those with no or bad credit history still have access to funding for debt consolidation, helping them merge multiple debts into a single manageable repayment.

Potential Benefits and Risks: What You Need to Know

Unsecured debt consolidation loans, despite their name, come with both advantages and potential drawbacks. For individuals in the UK with a bad credit history or no credit check requirements, this option can offer much-needed relief from overwhelming Credit Card Debt Consolidation. The primary benefit is the opportunity to simplify repayment by combining multiple debts into one loan, making it easier to manage. This strategy often results in lower monthly payments and can help individuals regain control of their finances.

However, there are risks associated with this approach. Lenders may offer less favourable terms and higher interest rates due to the lack of collateral or good credit standing. Moreover, unsecured loans could lead to further financial strain if repayments are missed, impacting credit scores even more. It’s crucial for borrowers to understand these risks and ensure they have a realistic repayment plan, seeking professional advice if needed, to make informed decisions regarding debt consolidation.

When exploring Credit Card Debt Consolidation options in the UK, understanding the available unsecured loans despite a bad credit history or no credit check is essential. This article has outlined the key steps and considerations for those seeking financial relief through consolidation. By following the process and being mindful of both benefits and risks, individuals can make informed decisions to improve their financial well-being.